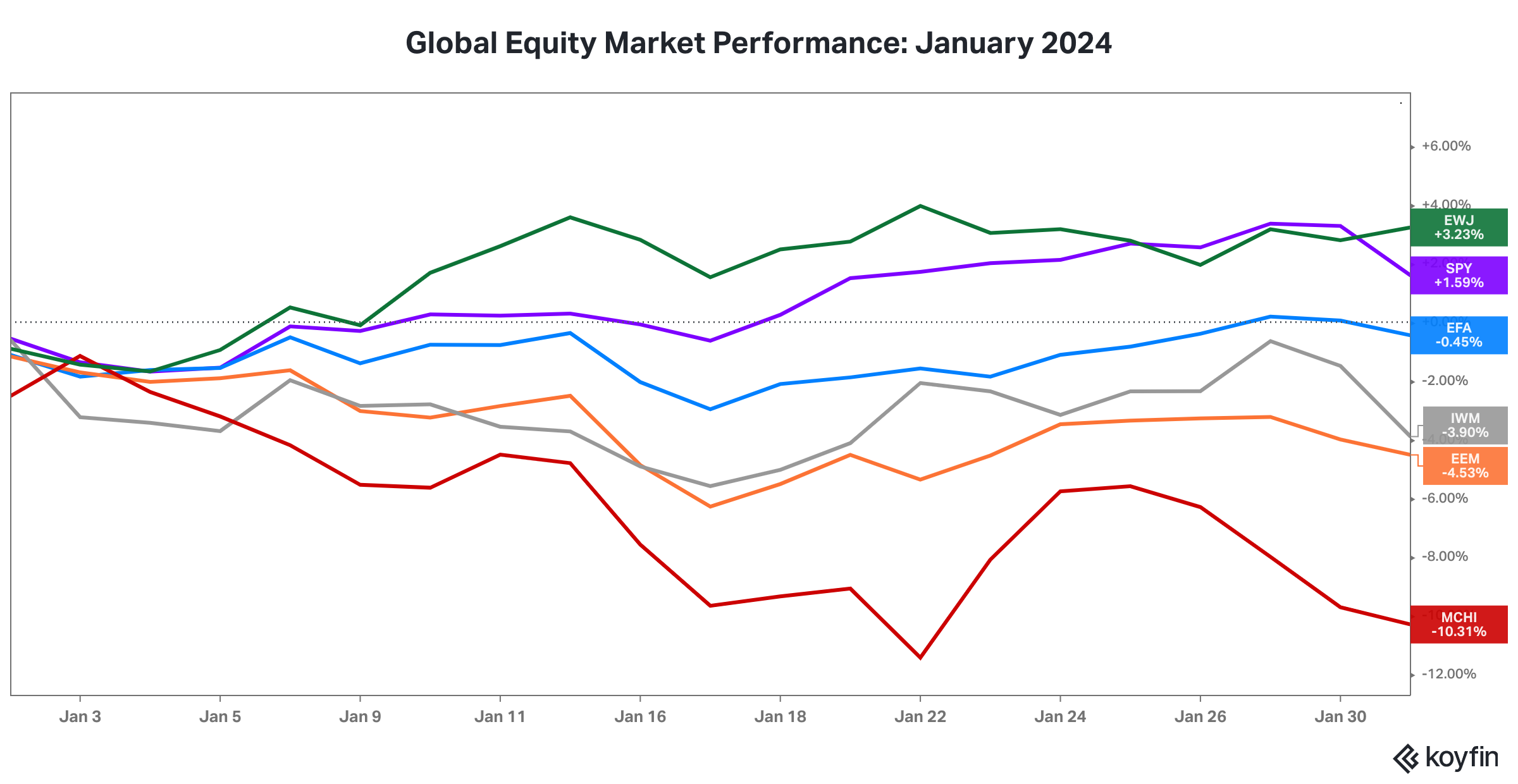

1. Global equity markets stumbled out of the gate in January with U.S. large cap stocks and Japan stocks as the only major categories to finish the month in the green.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange), IWM (iShares Russell 2000 ETF in grey), MCHI (iShares MSCI China ETF in red), and EWJ (iShares MSCI Japan ETF in green).

A slow start to the year is not surprising given the swift and strong global equity market rally over the last two months of 2023.

2. Treasury yields barely budged in January after the sharp decline into year-end.

Source: www.treasury.gov, Two Centuries Investments

3. Inflation remains the most important story for markets.

Inflation impacts the level and shape of the Treasury yield curve. Inflation has historically impacted equity valuation multiples. High inflation has led to lower multiples and lower investment returns. The last few decades have been a period of low growth in labor costs and low energy costs, both major drivers of rising corporate profit margins.

The rate of inflation peaked in the late summer 2022 but has not retraced its rise on the way down. It appears to have settled above its pre-pandemic range.

The headline inflation rate has dropped to about 1% above pre-pandemic levels but has plateaued in recent months.

The “Core” inflation rate (excludes food and energy) has proven even stickier and remains 2% above pre-pandemic levels.

4. The Federal Reserve faces a juggling act between employment, inflation, and its “other” mandate of ensuring financial system stability.

Structural supply shortages, most notably in the labor market, have reduced the effectiveness of tighter monetary policy in reducing inflationary pressures. Tighter monetary policy operates by increasing the cost of debt capital and thus, with a lag, puts downward pressure on the demand for goods and services. All else equal, less demand means lower wage growth and lower prices.

While the Federal Reserve Bank of Atlanta data shows wage growth across all industries continues to slow, there are many industries facing supply shortages. Over the last several months, United Airlines, American Airlines, and Southwest Airlines pilots were able to negotiate approximately 40% wage increases over the next four years. UPS union employees negotiated wage increases near 20% over five years and the UAW (United Auto Workers) negotiated 25% general pay increases plus cost-of-living adjustments over the next four years for the Big 3 auto workers.

The housing market is also experiencing a supply shortage. Despite higher mortgage loan rates, demand for housing remains high due to a demographic bump (children of baby boomers) in the age cohort (ages 25-40) with the highest percentage of new home buyers.

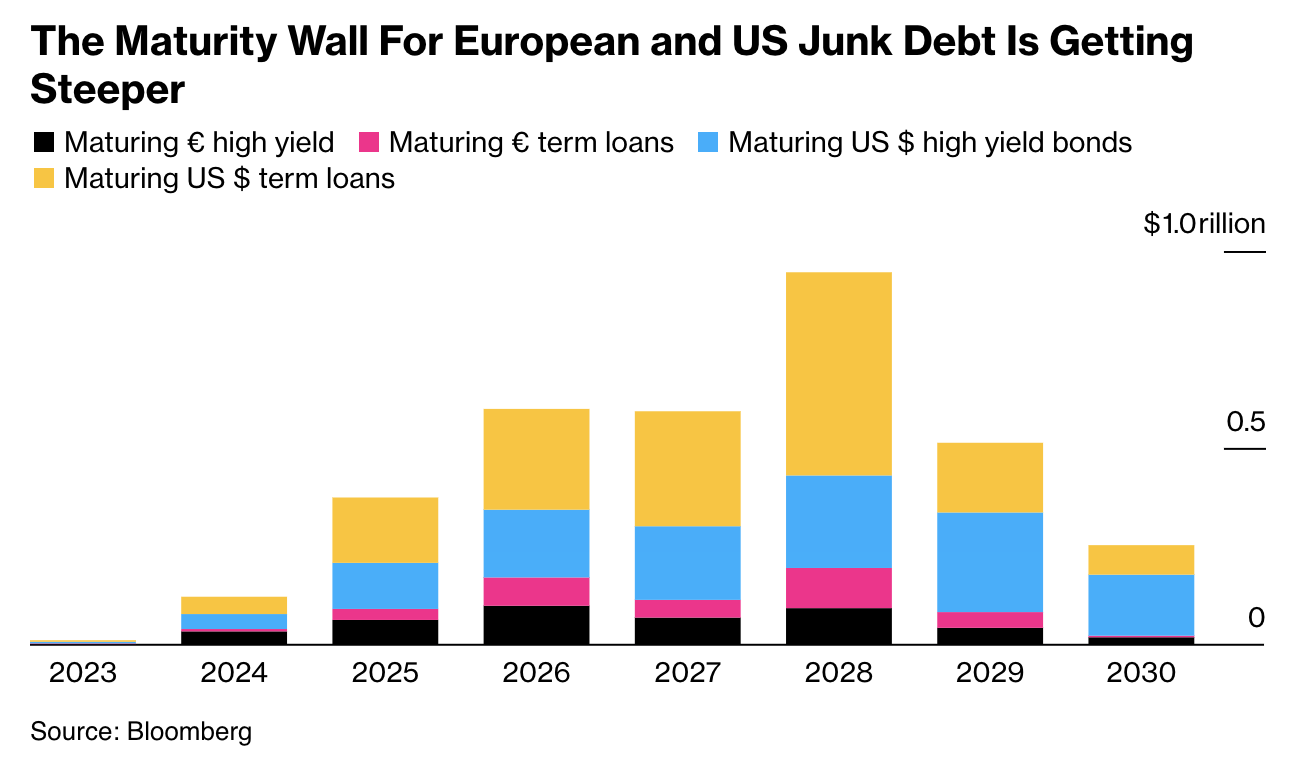

In addition, when interest rates were low prior to the 2022 spike, many corporations refinanced debt and either increased maturities or increased the percentage of fixed rate debt relative to floating rate debt. In other words, they companies have yet to feel the full brunt of the increase in interest rates. Over the next five years, over $4 trillion in corporate bonds will need to be refinanced at higher yields, as illustrated by the chart below from Calamos Investments, who used data sourced from the ICE BofA US Corporate Index and the ICE BofA High Yield Index, as of 10/19/23.

Bloomberg published a similar chart on September 29, 2023 showing the debt maturity wall for U.S. and European issuers.

Lastly, the Fed needs to consider the impact of shrinking its balance sheet on intermediate and long maturity Treasury yields at a time when the Department of the U.S. Treasury will be increasing the percentage of notes and bonds it issues going forward and reducing the percentage of Treasury bills.

In summary, the Federal Reserve is hoping to avoid dealing with any further trade-off between real GDP growth (the volume of goods and services being transacted) and inflation (the price of goods and services being transacted). The Fed also has to be careful not to further impair the capital position of the regional banks, most of whom are dealing with increased credit losses on commercial real estate loans. Recent comments from Federal Open Market Committee voting members reveal the Fed is more worried about a provoking a recession and damaging credit creation by banks than it is about pushing inflation lower in the near term.

5. Despite the Federal Reserve raising the federal funds rate target by 5.25% over a relatively short period, real economic growth has not collapsed, though it remains muted.

Real gross domestic product (GDP) and real gross domestic income (GDI) have diverged over the last few quarters. GDP data shows the economy humming along, while GDI data points to an economic slowdown.

6. Industrial activity and the manufacturing sector remain mired near recession levels, despite pockets of strong activity.

The recent weakness in industrial activity is apparent when viewed in the context of five-year and thirty-year trends.

With 46% of S&P 500 companies having reported quarterly earnings, the sectors with the lowest revenue growth are energy, materials, utilities, and industrials, namely the sectors most closely tied to industrial activity. The solid revenue growth in the information technology sector has been largely driven by software companies, while the semi-conductor companies most closely tied to industrial activity have reported weak revenue growth.

7. Economic growth has been supported by a massive increase in fiscal spending.

This fiscal deficit is still at levels only seen during recessionary periods when tax receipts decline and fiscal spending increases.

8. Consumer spending has been the other pillar of economic activity.

However, U.S. consumer debt growth is running well above economic growth. The strength in consumer spending is increasingly driven by borrowing and less by wage income growth, a concerning development.

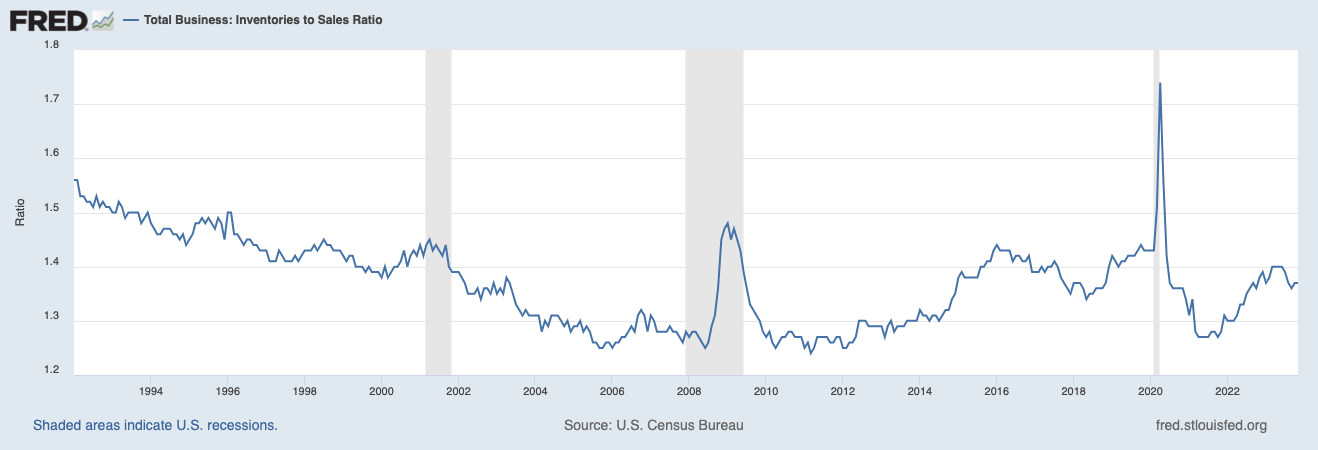

9. Inventory levels bear watching.

As of November 2023. the inventory-to-sales ratio had risen from post pandemic lows to the upper end of its post 2002 range.

10. Credit markets will likely be the canary in the coal mine, as the typically are, if a sustained economic contraction is forthcoming.

At month end January 2024. high yield bond spreads had settled around 1.5% below long-term averages and well below recent peaks. Good news for sure.