Here are the top market developments we have been watching in July.

1. Inflation remains the dominant narrative as it continues to rise.

Company management teams continue to mention inflation (rising material and labor costs) as a headwind to earnings.

This chart illustrates the 12 month change in CPI-U index over the last 12 years ending May 31, 2021. The chart also shows the “Core” CPI-U index, which excludes food and energy.

Government inflation data shows the acceleration in inflation measures. The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.9 percent in June on a seasonally adjusted basis after rising 0.6 percent in May. The “core” index (excludes food and energy) also rose 0.9 percent in June after increasing 0.7 percent in May. Over the last 12 months, the all items index increased 5.4 percent before seasonal adjustment, the largest 12-month increase since a 5.4 percent increase in the summer of 2008.

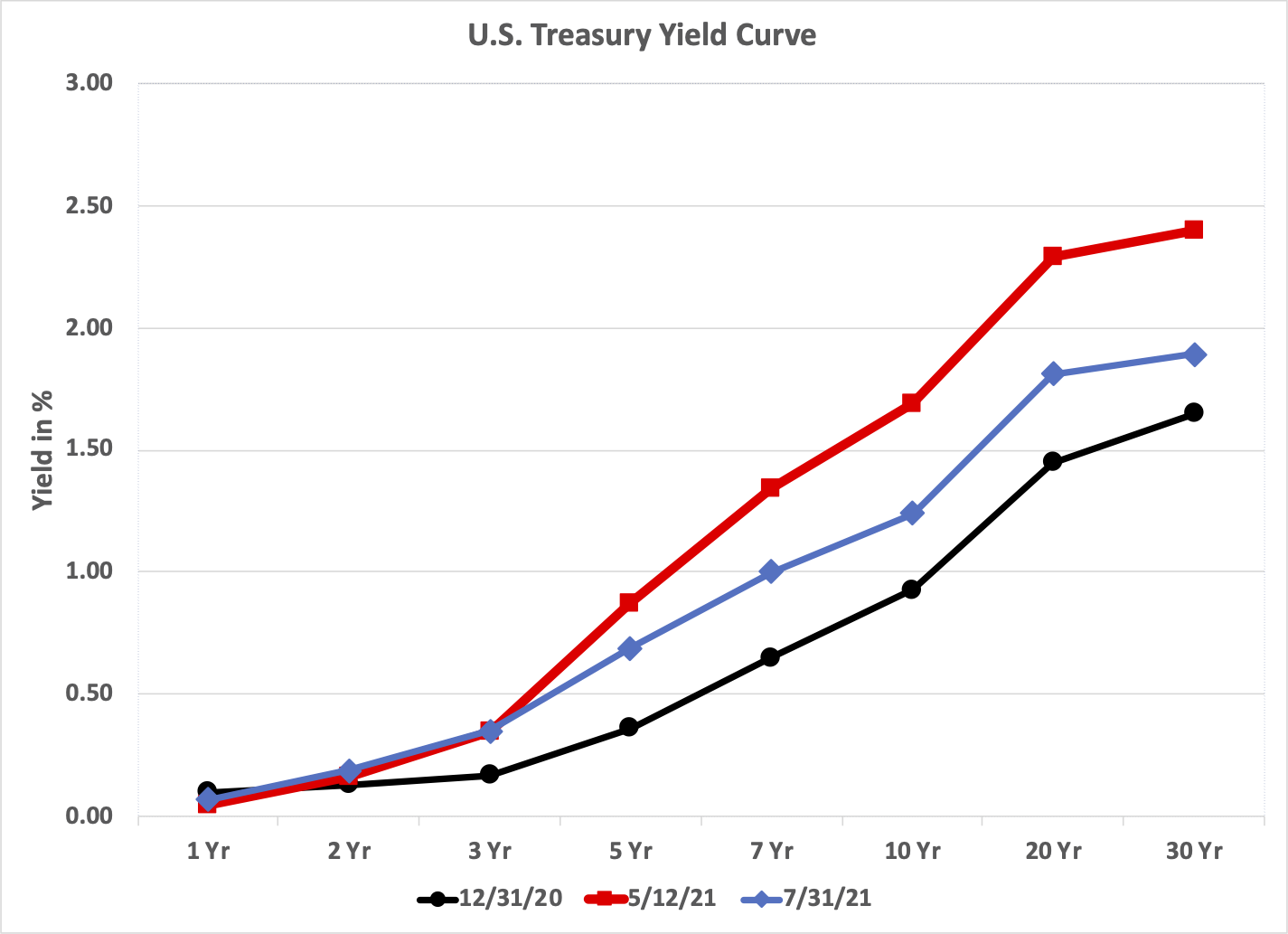

Source: treasury.gov

Fascinatingly, despite the inflation narrative, long-term interest rates are now closer to beginning of year levels than to their recent highs on May 12, 2021. Admittedly, Federal Reserve purchases of Treasuries, demand from foreigners attracted to the relatively higher US interest rates, and concerns about the Delta variant have exerted downward pressure on US Treasury yields. However, we sense the Treasury market is hinting real economic growth may trend back towards the muted levels of recent years.

2. On the other hand, real economic growth appears to be plateauing.

It is difficult to forecast economic growth in normal times. However, until we lap the discontinuity of the second and third quarters of 2020 (specifically a massive real GDP decline and a subsequent sharp rebound) detecting trends will be near impossible. That said, the government’s first estimate of 6.5% real GDP growth in the second quarter of 2021 was a disappointment. It was below the economic forecaster consensus of 8.4% according to Dow Jones and followed a growth rate of 6.3% in the first quarter of 2021. The growth rate is strong by historic standards, but the tailwinds of the massive fiscal stimulus seem to be fading sooner than anticipated. We will wait for another three months of economic data before drawing any conclusions.

3. Corporate earnings results have been excellent, but comparisons start to get more difficult next quarter.

Source: FactSet

This chart shows revenue growth for S&P 500 companies that have reported earnings results by July 30.

With 59% of S&P 500 reporting, revenue growth is up 23% and earning growth is up 85% year-over-year. Not surprisingly, the economically sensitive sectors, namely energy, materials, consumer discretionary, and industrials have experienced the sharpest rebounds and strongest revenue growth. Just like with economic growth, it is difficult to read too much into the earnings results until we lap the discontinuity of 2020.

4. The Chinese stock market sold off due to new government regulations impacting the for-profit education sector.

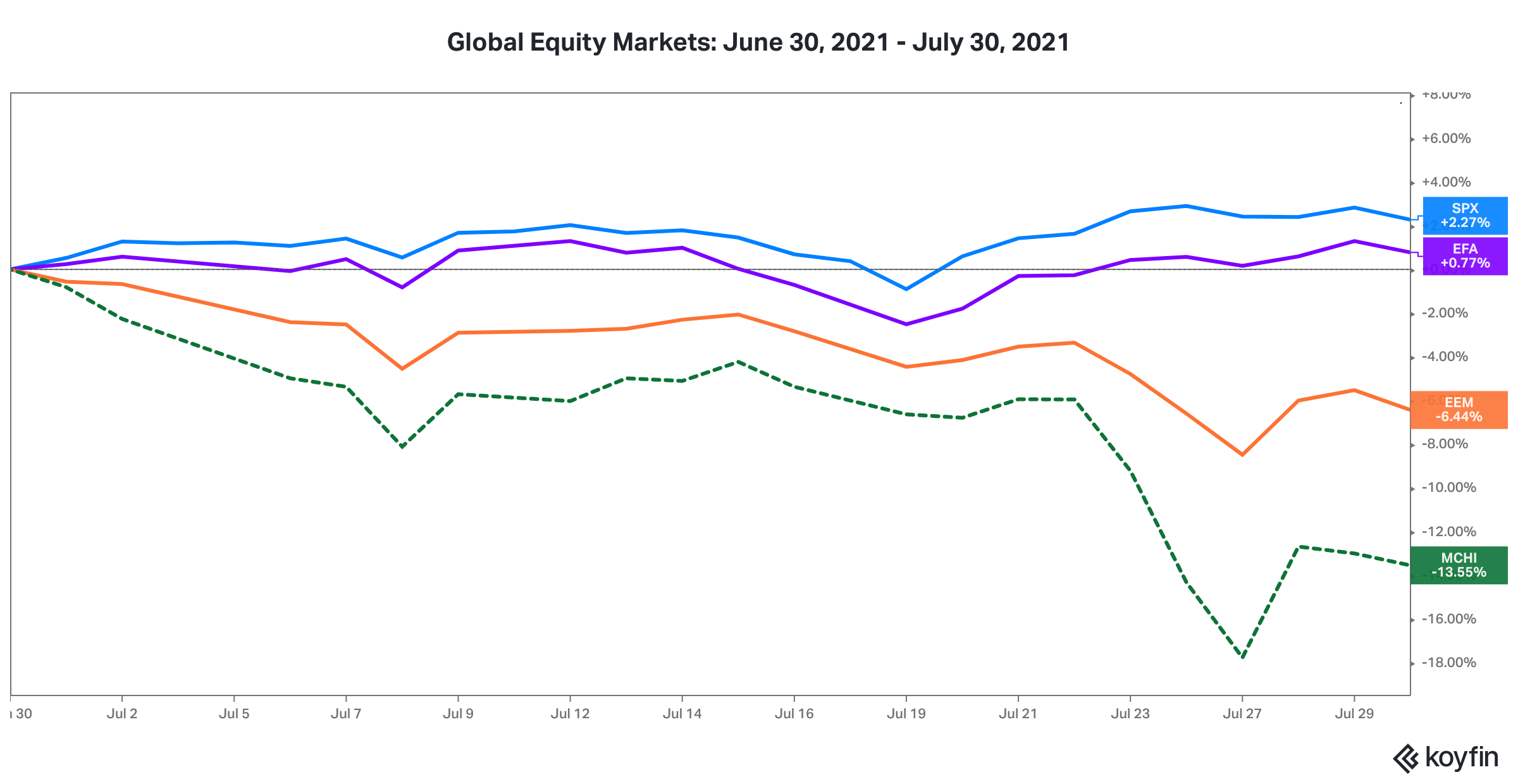

The graph shows the total return for the S&P 500 Index in blue, the iShares MSCI EAFE ETF in purple, the iShares MSCI Emerging Markets ETF in orange, and the iShares MSCI China ETF in green (dashed) for the month of July 2021.

In July, emerging markets equities significantly underperformed developed market equities, driven by the Chinese government’s deepening crackdown on private education companies, following its crackdown on the information technology sector. Whether there are broader implications for the Chinese equity market is to be determined. However, it is becoming increasingly clear the Chinese government is worried about the appearance of companies and investors earning extraordinarily high investment returns at the same time wealth inequality has widened in the country.