While still very relevant for attribution, correlation estimation, and risk modeling, relying on traditional factors will not beat passive market returns. The only sustainable way to do that is with dedication to innovation.

It is more prudent to assume that quant factors are anomalies rather than risk premia.

Assuming that factors are anomalies ensures that the quant team:

continues to generate material innovation, which is the source of true alpha

diversifies ideas away from a handful of the most popular factors; and

risk manages the ex-ante factor drawdowns.

However, the challenge is explaining this assumption to clients because:

anomalies are fleeting and often idiosyncratic, “Risk premia” therefore sounds much more reliable.

anomalies can be arbitraged away, whereas “Risk premia” sound closer to a ‘natural law of finance’.

anomalies require investment in innovation which is generally at odds with the investment process that was sold to clients, whereas “Risk premia” are the ultimate version of a frozen investment process that is not expected to materially evolve over time.

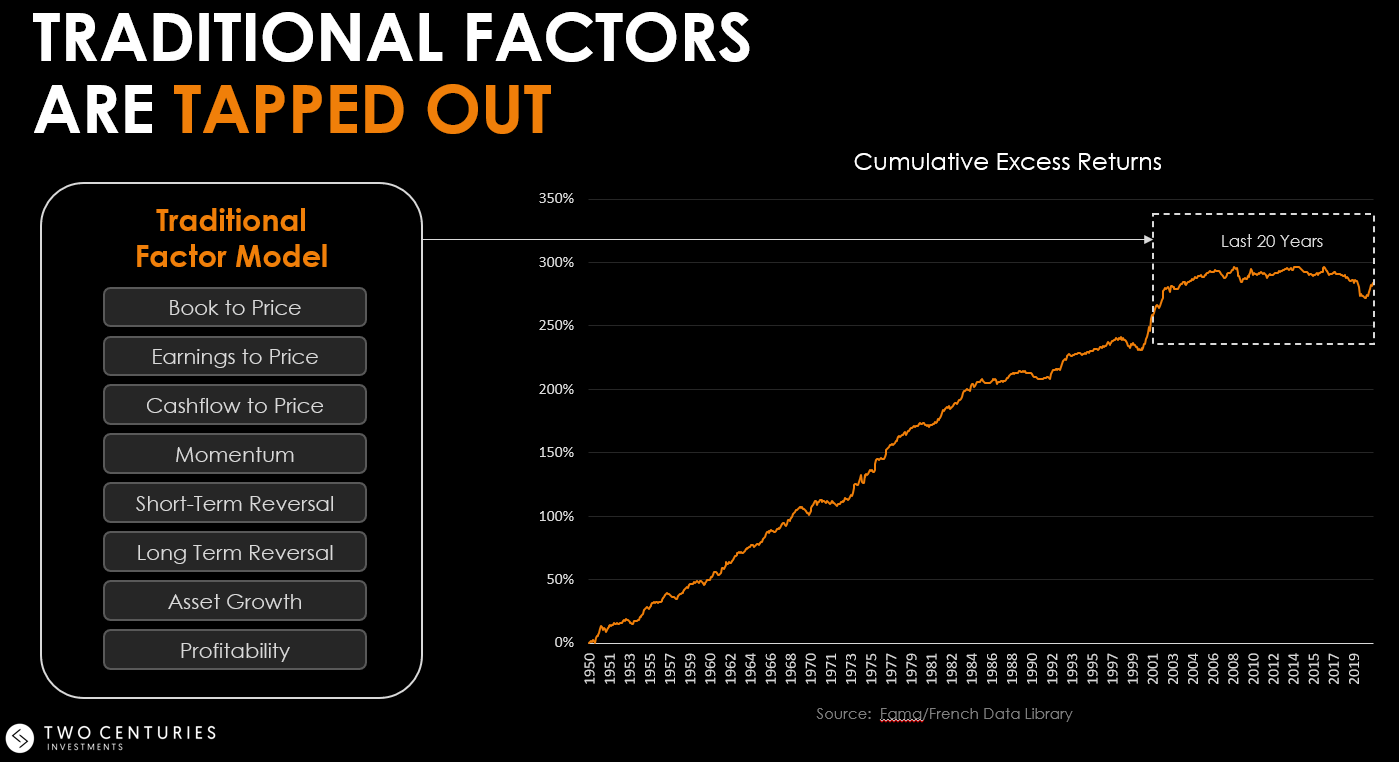

The chart below is the average return of the popular “Nobel prize winning” factors most allocated to by traditional quants and smart beta products (i/e the Fama-French factor library). This inverted hockey stick is not what risk premia is supposed to look like. It doesn’t take any statistical analysis to see a meaningful structural change in the average return during the past 20 years.

Even if the anomaly assumption proves wrong, the quants still benefit from additional innovation, while the popular factors continue to deliver the ‘expected risk premium’. On the other hand, if the assumption proves correct and traditional factors, have in fact, lost their alpha, the additional innovation becomes even more critical to generate alpha going forward. This is related to the idea that type 2 error is more harmful than type 1 error.

Let’s face it, despite all the hard efforts and long working hours, the investment industry has not always served its clients well. During the past 15 years, almost 9 out of 10 active managers has underperformed. We believe the root cause of this underperformance is industry-wide lack of creativity and innovation.

At Two Centuries we are passionate about innovation. Not only do we create our own strategies that invest based on proprietary analysis that authentically aligns with our beliefs (Our Focused Quality strategy, for example, is based on analyzing company’s intangible assets), we also help other investment managers discover their innovation edge.

We do this because we believe collaborative innovation can generate material improvements that will help restore creativity to our industry, which translates into value add for the clients. We also do it because it's a lot of fun! If you are interested to partner with us to drive innovation, please reach out.