Knockin’ on Leverage’s Door is a reference to "Knockin' on Heaven's Door", a song Bob Dylan wrote in 1973 for the movie Pat Garrett and Billy the Kid. Recent generations likely associate the song’s cover with musicians Eric Clapton and the band Guns N’ Roses. The song’s lyrics depict a frontier lawman, Slim Pickens, who has been shot and is near death. Slim Pickens is on his way to the afterlife and maybe heaven awaits him.

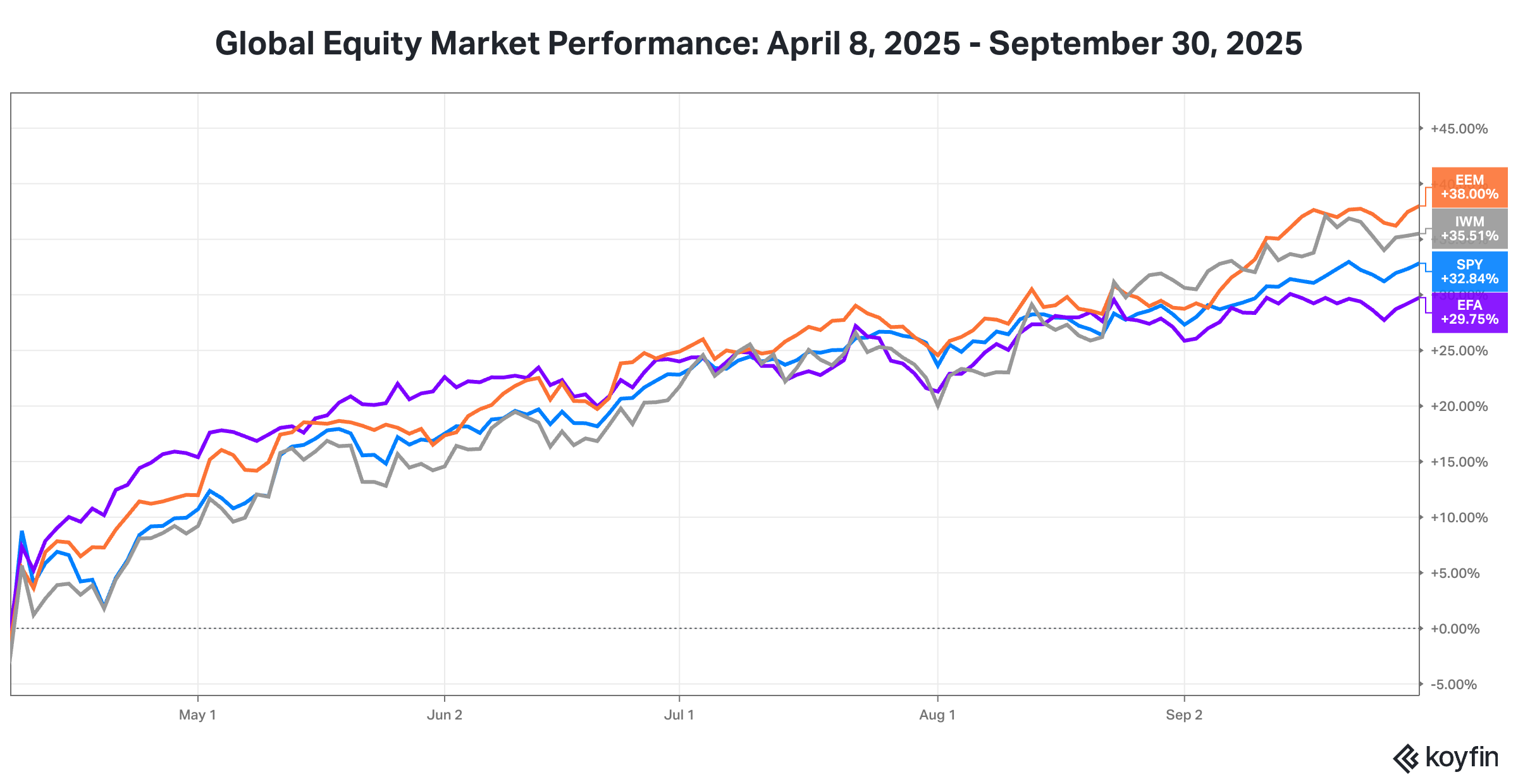

Stock market investors have been enjoying a slice of heaven. Since April 8, one week after the April 1 Liberation Day tariffs were announced by the Trump Administration, the U.S. stock market has marched steadily higher, with the S&P 500 index rising 32% by the end of September. Non-U.S. stocks have enjoyed an upward surge of a similar magnitude.

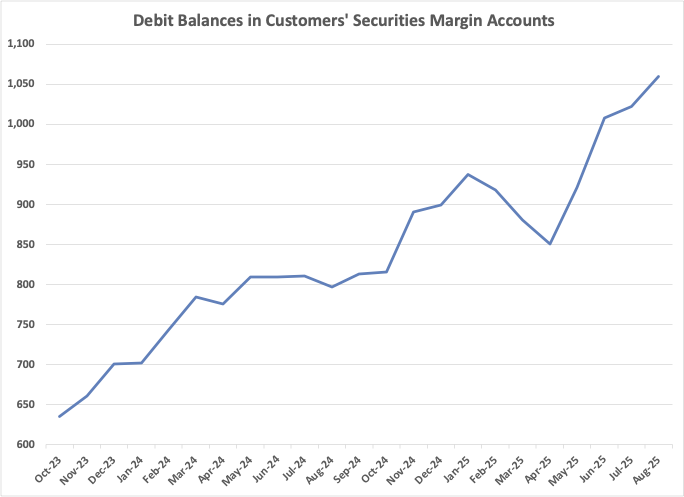

Where has the relentless buying power come from? The data says the continued upward surge has been driven by investors Knockin’ on Leverage’s Door. In other words, investors have increased their buying power by adding lots of financial leverage, i.e., buying stocks on margin.

From our perspective, the spike in stock prices driven by leverage is concerning in light of equity market valuations sitting at or above prior historical peaks. An economic, financial or geopolitical shock could ignite a cascade of margin calls, generating a large drawdown in the stock market. For investors, the afterlife of a margin call spiral is often akin to knockin’ on hell’s door.

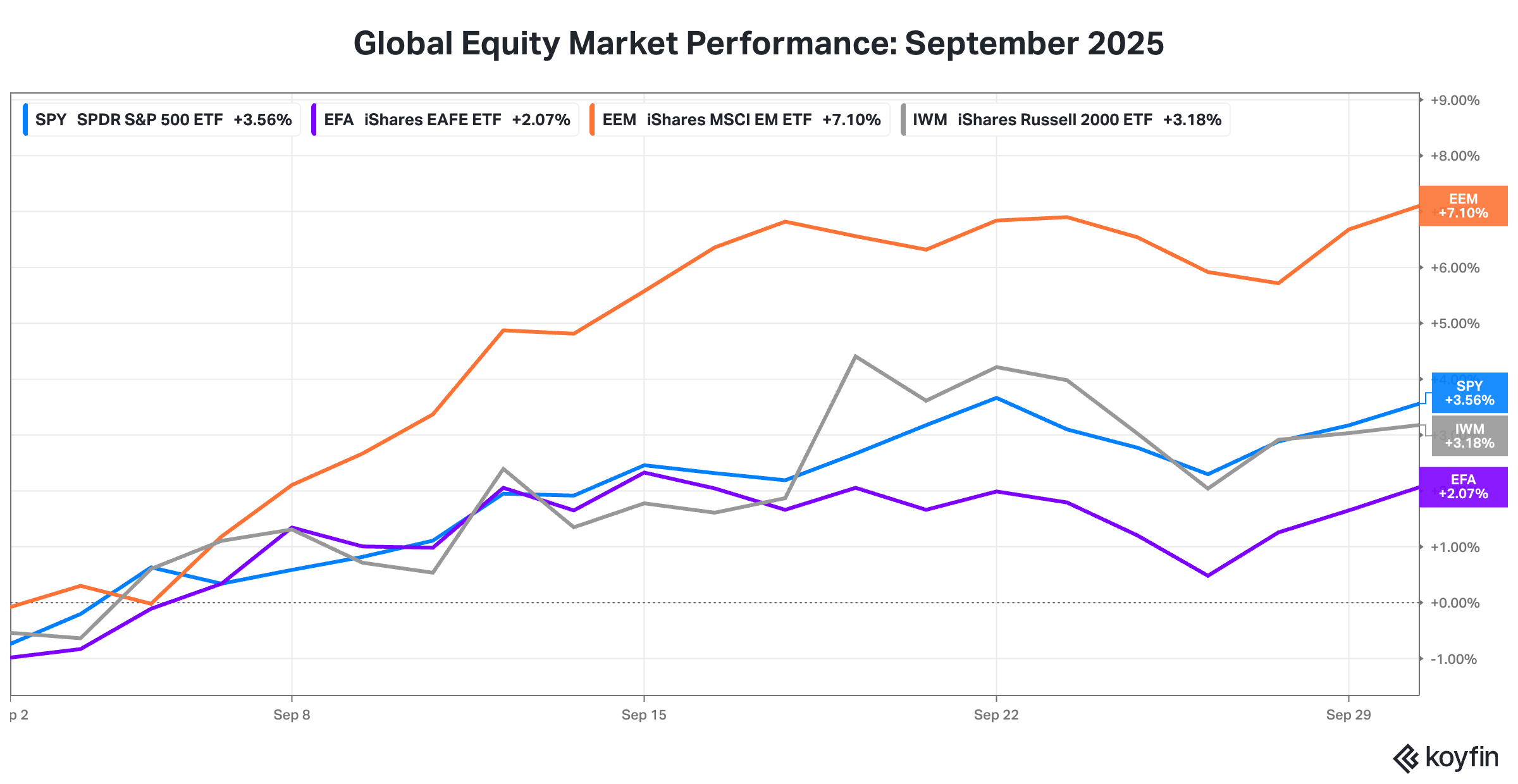

1. Global equities had a strong September, led by emerging markets.

2. Since April 8, the U.S. stock market has marched steadily higher, with the S&P 500 index rising 32% by the end of September.

Non-U.S. stocks have enjoyed an upward surge of a similar magnitude.

3. Margin loan balances rose 24.6% in just four months from April to August.

Source: FINRA

Margin loan balances are up an outstanding 67% since October 2023.

4. U.S. equity market valuations are near all-time highs.

5. The performance leaders remain an unlikely duo, namely Artificial Intelligence linked stocks and gold.

Artificial Intelligence is equated with innovation and productivity while gold is an unproductive asset unlike its sibling commodities, copper and silver.

NVDA is the ticker for shares of NVIDIA Corp, the semiconductor company whose GPU chips have come to dominate the AI landscape.

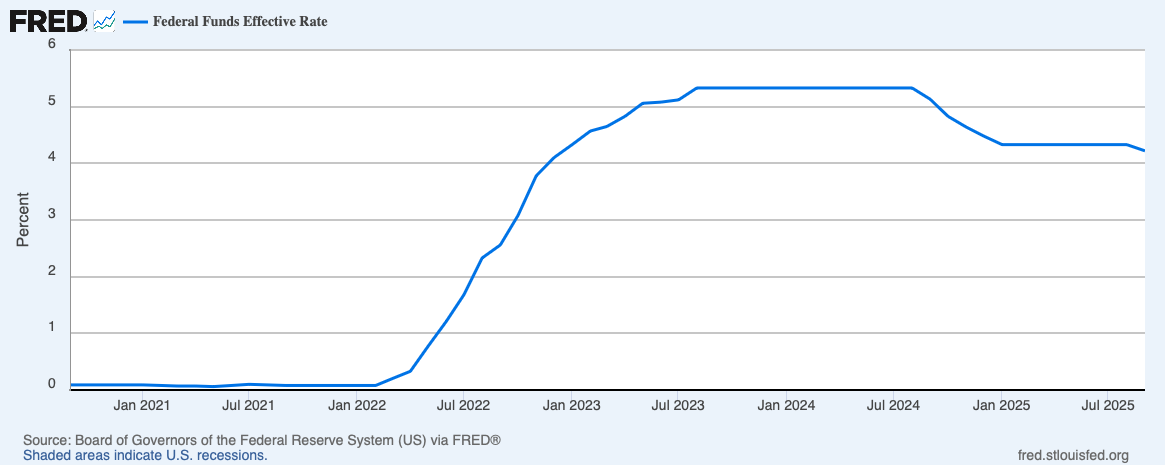

6. In mid September, the Federal Reserve announced a quarter point cut to the Federal Funds Rate to a range of 4.00% to 4.25%.

It had been nine months since the Fed reduced its policy rate. While the U.S. inflation rate hovers near 3%, a full percentage point above the Fed’s 2% target, and the U.S. unemployment rate remains quite low at 4.3%, the Fed is clearly concerned about the lagged negative impact of tariffs on economic activity.

The Fed’s rate decision reflects a risk management mindset in contrast to the YOLO (you only live once) investor mentality of reaching for returns via financial leverage. Alarmingly, investors speculating via increased leverage seem to believe the Fed not only has their backs, but has the tools to proactively save them from their folly.

Disclosure: Two Centuries Investments is a registered investment advisor. That material is for general information and reference purposes only and does not constitute tax, legal, or investment advice and is not intended as an offer to sell, or a solicitation to buy securities, services or investment products. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed, and reliance should not be placed on the information presented. This material may not be reproduced, copied, or transmitted, or any of the content disclosed to third parties, without the permission of Two Centuries Investments. Past performance is not a guarantee of future results.