At its July meeting, the Federal Open Market Committee (FOMC) once again decided not to change the Federal Funds Rate target. Despite no easing of monetary policy in the U.S., there has been no easing up of the global equity market rally.

1. Global equity markets have been on a tear since their April 8, 2025 trough, which was driven by the Trump Administration’s tariff proposal on the so-called “Liberation Day”.

In the U.S., high beta stocks have led the rebound, followed by pure growth stocks. Low volatility stocks have been the laggards. It has been a “risk-on” rally, not a gradual, climb the wall of worry rally.

2. Year-to-date, non-U.S. equity markets continue to significantly outperform U.S. equites, in a reversal of the prior multi-year trend.

More than half of the non-U.S. equity market outperformance can be directly attributed to the currency impact of a weaker U.S. Dollar.

3. Credit spreads in the high yield bond market also reflect the “risk-on” sentiment as they are hovering below 3%, not far from their lowest level in the last decade.

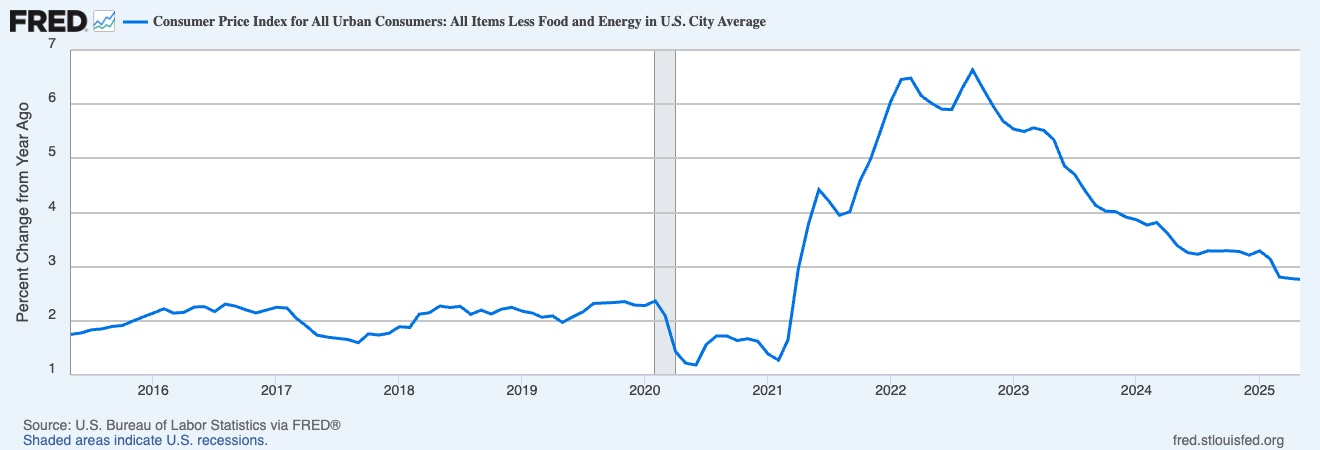

4. The rate of inflation, excluding food and energy, appears to be settling below 3%, but still above its pre-pandemic trend.

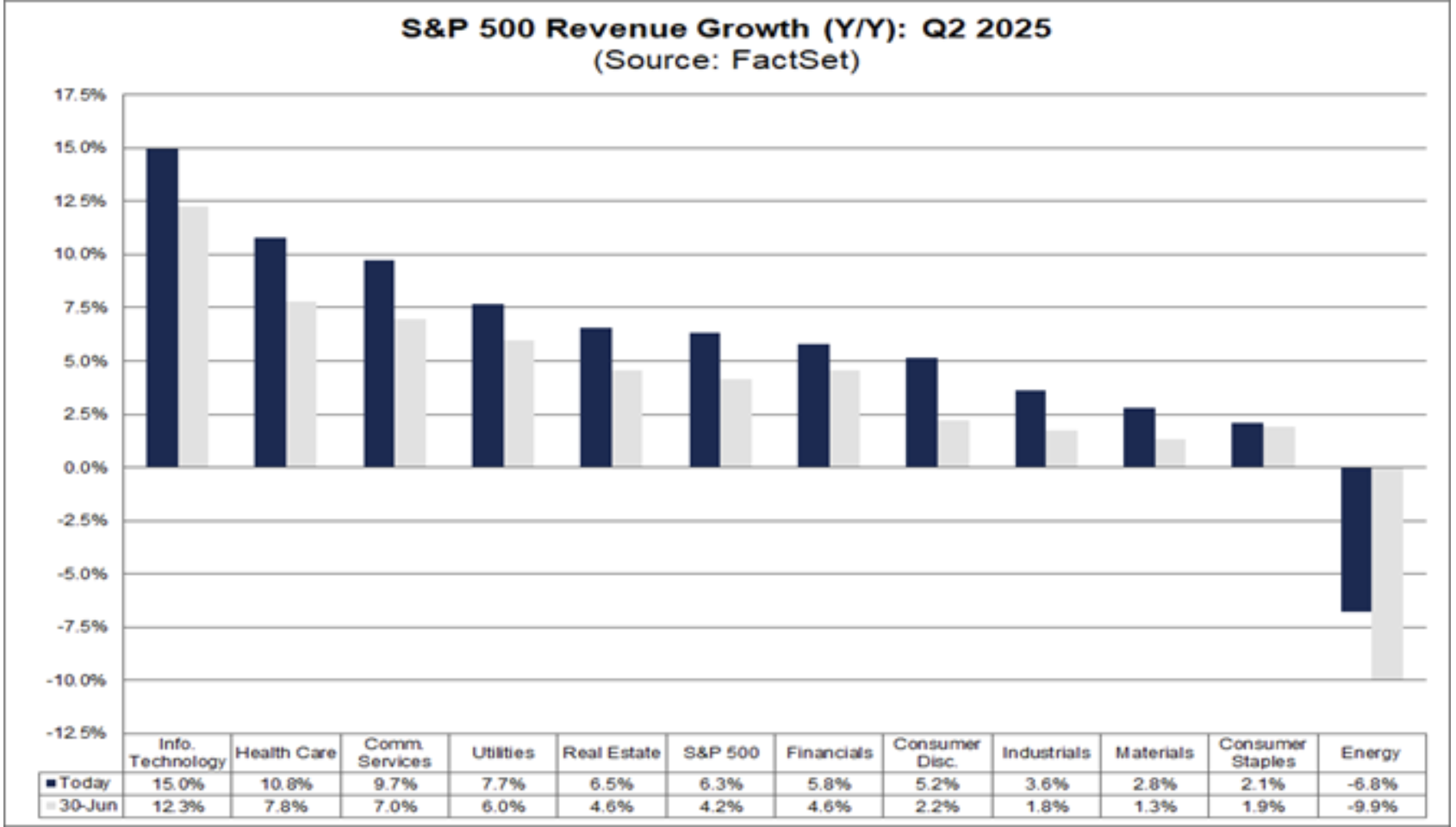

5. Second quarter earnings for S&P 500 companies have been buoyed by extremely strong earnings reports from largest companies within the communication services and information technology sectors.

90% of S&P 500 companies have reported earnings as of August 8.