The Federal Reserve faces a dilemma, to ease or not to ease.

The U.S. economy is running hot as evidenced by the rate of real economic growth, the inflation rate, and the historically high level of fiscal spending. The U.S. equity market and the U.S. high yield bond market continue to generate exceptional returns. Easier monetary policy could provide fuel for higher inflation, U.S. dollar depreciation and increased asset market speculation, and lead to a damaging unwind of excesses in the future.

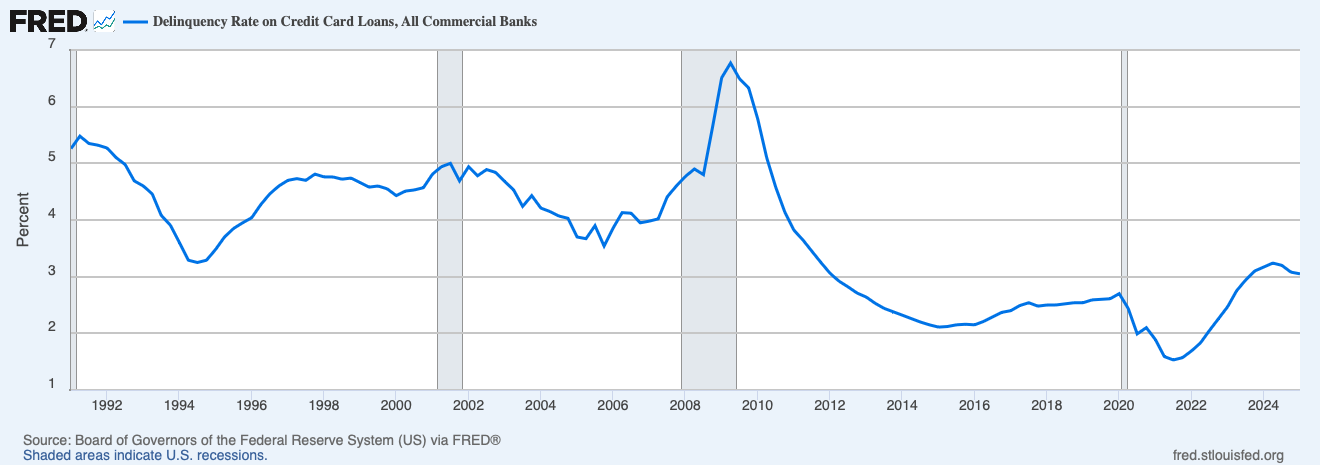

On the other hand, U.S. bankruptcy filings have been rising at a rapid rate and credit card delinquency rates are at their highest level since 2012. The negative impact of tariffs on economic activity also looms on the horizon. Easier monetary policy may be appropriate if looming economic weakness in the private sector is being masked by the high level of government spending.

1. Global equity markets have been on a tear since their April 8, 2025 trough, which was driven by the Trump Administration’s tariff proposal on the so-called “Liberation Day”.

Year-to-date, non-U.S. equity markets continue to significantly outperform U.S. equites, in a reversal of the prior multi-year trend.

2. In the U.S., momentum and quality free-cash-flow generation factors continue to drive exceptionally strong equity market returns.

Momentum and quality free-cash-flow generation have consistently been the top performing factors for the last fifteen years. The trailing twelve months were the same as it ever was.

Source: S&P Dow Jones Indices, as of June 30, 2025

3. Credit spreads in the high yield bond market are hovering at their lowest level post the 2008 Global Financial Crisis.

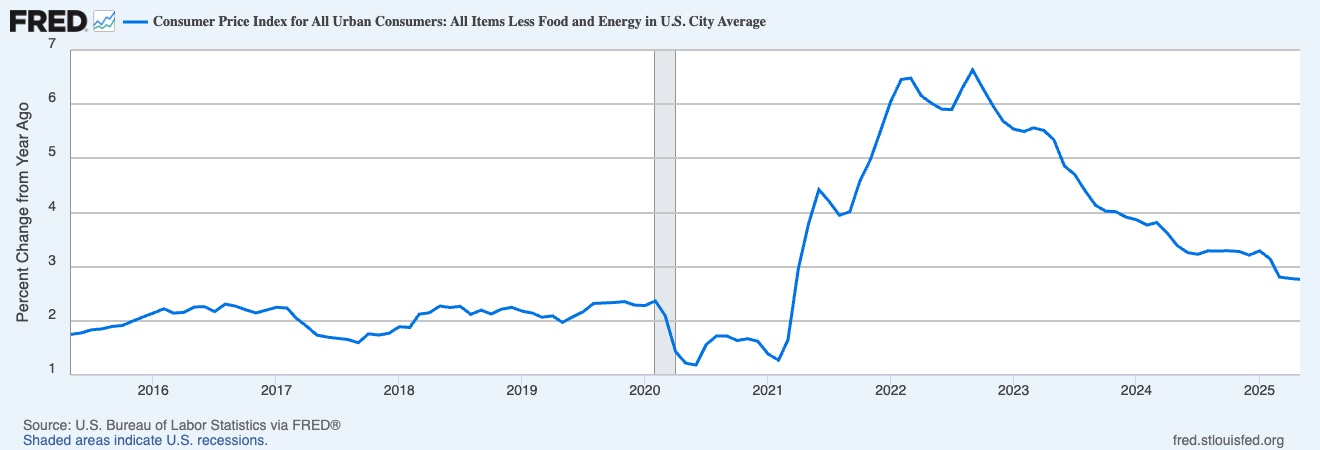

4. The rate of inflation, excluding food and energy, appears to be settling below 3%, but still above its pre-pandemic trend.

5. Real economic growth remains solid. In first quarter of 2025, real economic growth decreased at a 0.5% annualized rate, dragged down by increased imports and reduced government spending.

6. Fiscal spending is likely to reaccelerate with the signing of the reconciliation bill by President Trump. As a result, the federal deficit will continue to trend at its highest level since the World War II period.

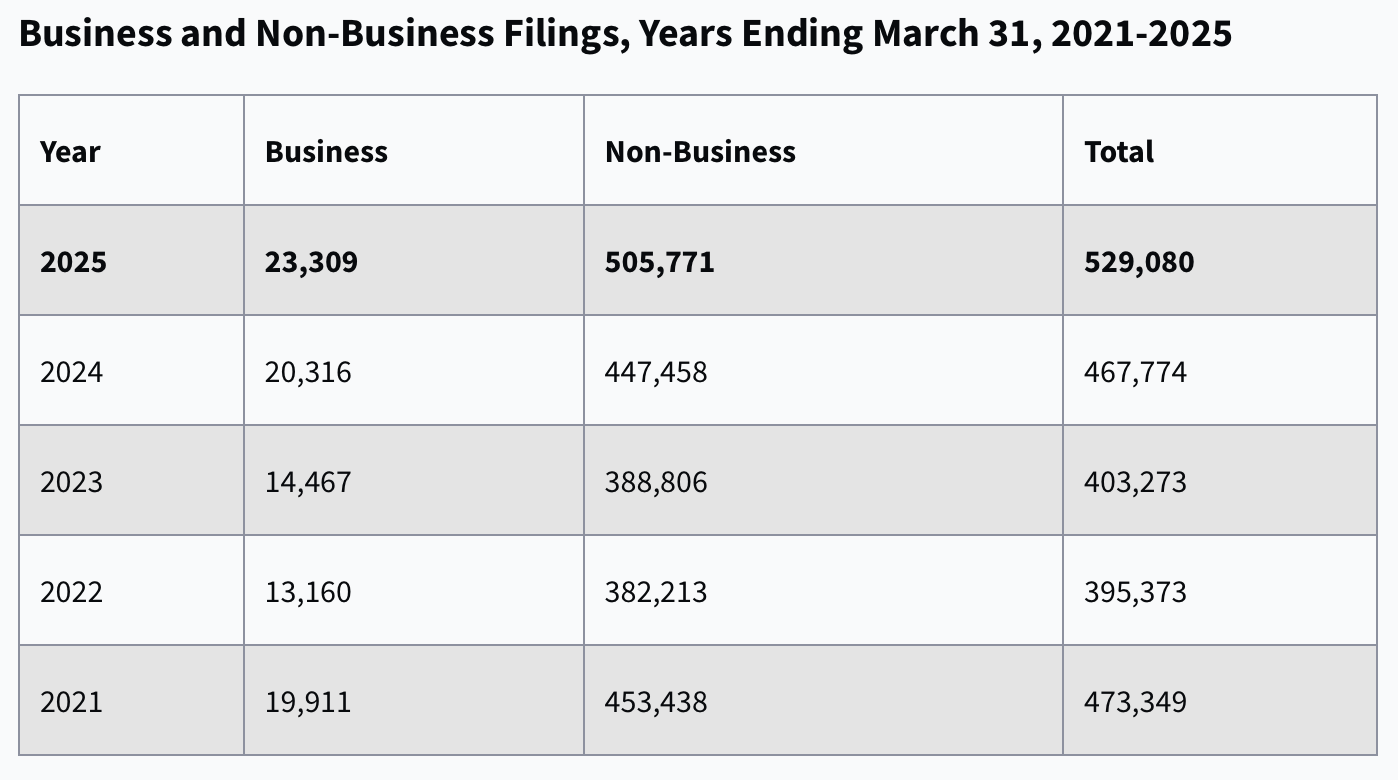

7. U.S. business and non-business bankruptcies increased 13% year-over-year in March and continue to trend upwards from the 2022 lows.

Source: www.uscourts.gov