1. Global equity markets continued to rebound in May as it became apparent the proposed “Liberation Day” tariffs would be reduced and implementation delayed.

Year-to-date, non-U.S. equity markets continue to significantly outperform U.S. equites, in a reversal of the prior multi-year trend.

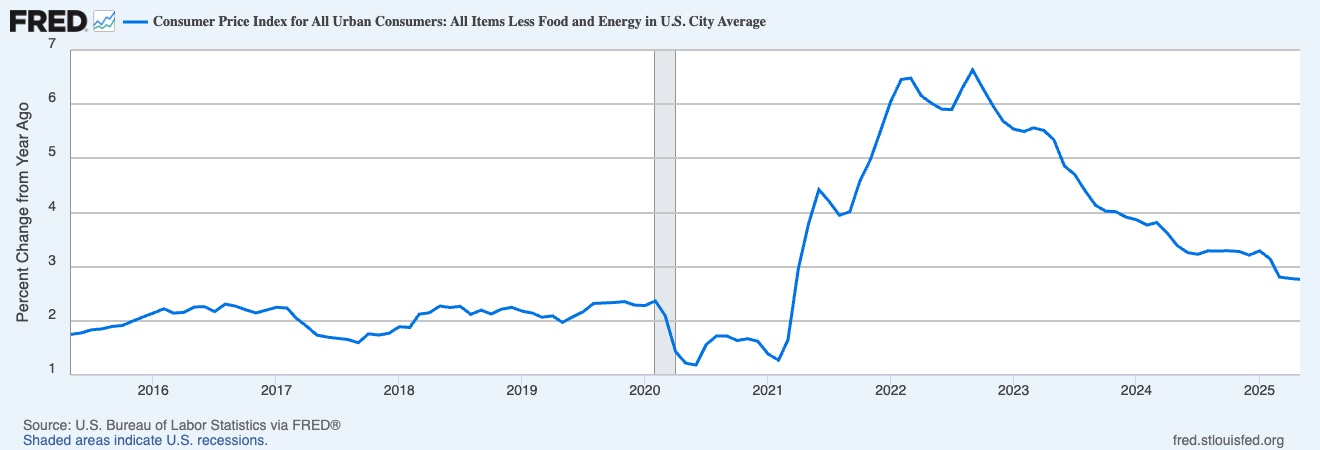

2. The rate of inflation, excluding food and energy, appears to be settling below 3% after having plateaued near 3.25% for several months.

The Atlanta Federal Reserve Bank’s measure of “sticky price” inflation (think rent, insurance and medical care) continues to decline.

3. The Federal Reserve is facing a policy dilemma, and not just due to the uncertainty about tariffs. The Fed may be trapped when an economic downturn occurs.

Since year-end 2023, long term interest rates have risen, despite

inflation declining by 1.1%, as measured by the year-over-year change in CPI excluding food and energy. and

the Federal Reserve cutting the Federal Fund Rate target by 1.0%.

The ten-year U.S. Treasury note yield has risen 52 bps and the thirty-year U.S. Treasury bond yield has risen 89 bps.

The real growth rate of GDP (economic activity) has not risen, but has plateaued around 2.5%.

The federal deficit is running at its highest level since the World War II period. Given the federal debt to GDP ratio, the current federal deficit level is unsustainable, unless it is going to help generate a productivity boom.

Federal Debt to GDP has risen above 100%.

The optimal outcome is a productivity boom, raising the growth rate of real GDP, lowering inflation, and putting downward pressure on long-term interest rates.

However, if an economic downturn occurs before a productivity boom, then the ratio of federal deficit will increase from its historically high post-WWII level and federal debt to GDP will rise even further.

The Fed would have to consider whether its typical policy response of lowering the Federal Funds Rate would lead to a dangerous combination of higher long-term inflation expectations, higher long-term interest rates, higher U.S. government funding costs, and U.S. dollar depreciation.