1. July was the second consecutive strong month for global equity markets.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange) and IWM (iShares Russell 2000 ETF in dark grey).

U.S. small-cap stocks were the star performers for the second consecutive month.

2. While the year-to-date outperformance of U.S. large cap equities remains intact, U.S. small cap and emerging markets equities have closed the gap over the last two months.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange) and IWM (iShares Russell 2000 ETF in dark grey).

We would not be surprised if U.S. small cap, non-US developed markets and emerging markets equities continue to outperform U.S. large cap equities. Over the last five years, U.S. large cap has outperformed both U.S. small cap and non-US developed markets by around 50% and has outperformed emerging markets by over 70%.

3. What lies ahead for financial markets will likely be driven by the path and composition of inflation.

The level of inflation has historically impacted equity valuation multiples. High inflation has led to lower multiples and thus lower investment returns. The composition of inflation will also impact earnings. The last few decades have been a period of low growth in labor costs and low energy costs, both major drivers of rising corporate profit margins.

The headline inflation rate is now only 1% above pre-pandemic levels.

The concern is the “core” inflation rate (excludes food and energy) has proven stickier and remains almost 3% above pre-pandemic levels.

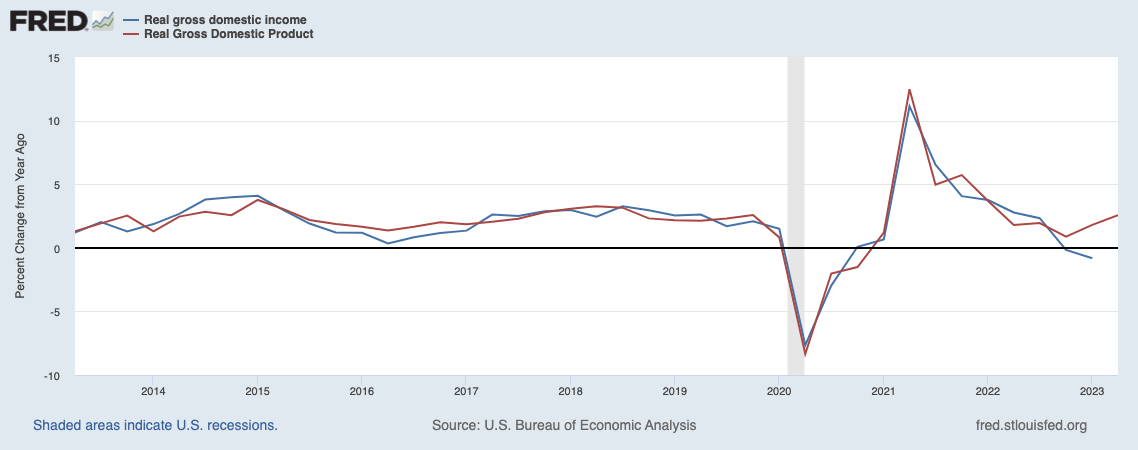

4. Despite the Federal Reserve raising the federal funds rate by 5% over the last sixteen months, real economic growth has not collapsed, though it remains muted.

According to the "advance" estimate from the U.S. Bureau of Economic Analysis, real gross domestic product (GDP) even picked up from its recent trend, increasing at an annual rate of 2.4% in the second quarter of 2023.

Real gross domestic income (GDI) data for the second quarter is not yet available. The GDI data diverged from the GDP data in first quarter and pointed to an economic slowdown. These data series will converge, the question is in which direction.

5. The challenge the Federal Reserve faces is how to balance its dual mandate of maximum employment and stable (2% target) inflation.

In the current economic environment. the Federal Reserve cannot achieve its inflation target without risking a significant rise in unemployment and a recession. Because of structural supply shortages, most notably in the labor market, tighter monetary policy is less effective in reducing inflationary pressures. Tighter monetary policy operates by increasing the cost of debt capital and thus, with a lag, puts downward pressure on the demand for goods and services. The dilemma is the Federal Reserve may have to risk crushing real GDP growth (the volume of goods and services being transacted) in order to crush inflationary pressures (price of goods and services being transacted).

While the Federal Reserve Bank of Atlanta data shows wage growth across all industries continues to slow, there are many industries facing supply shortages. Recently, United Airlines and American Airlines pilots were able to negotiate 40% wage increases over the next four years. Currently, the UAW (United Auto Workers) is demanding a 46% pay increase deal and FedEx pilots are demanding a 30% pay rise.

Adding to the challenge facing the Federal Reserve is the demand for mortgage loans is contracting at a much slower pace. The rapid rise in mortgage rates in 2022 crushed mortgage loan issuance and appeared to be putting the brakes on housing construction. As housing construction remains an important driver of economic activity, any sustained strength in construction activity will contribute to inflationary pressure.

Lastly, crude oil prices have risen recently. Continued strength in oil prices will put upward pressure on headline inflation, potentially make core inflation stickier, and further complicate the Federal Reserve’s balancing act.

6. Corporate earnings growth in the second quarter 2023, while better than expected, was still the weakest growth in almost three years.

With 84% of the companies in the S&P 500 Index having reported quarterly earnings, earnings declined 5.2% and revenues declined 0.6%, year over year.

7. While most of the world is dealing with inflationary pressures and many central banks are still raising short-term interest rates, in contrast China is facing the risk of a credit crisis and deflation.

This chart shows the People’s Bank of China one-year medium term funding rate versus the U.S. Federal Reserve’s federal funds rate (overnight rate)

China’s central bank, the PBoC, once again cut its one-year medium-term lending facility (MLF) rate, to 2.50% on August 15th, as it seeks to support economic growth weighed down by a deepening property crisis and muted consumer spending.

Country Garden, a real estate developer with $194 billion in liabilities at year end 2022, missed payments of $22.5 million on two of its offshore dollar bonds. Trading in eleven of its onshore bonds was suspended. A default appears to be a foregone conclusion.

China Evergrande, once China’s largest property developer by sales, filed for Chapter 15 bankruptcy in New York on August 17. Its meltdown began in September 2021 and triggered a chain of failures across the Chinese property sector, which is estimated to represent as high as 30% of China’s GDP. We discussed Evergrande in our December update (December 2021 Market Update).

How the Chinese government navigates the real estate crisis bears monitoring for two reasons.

The Chinese economy is a significant source of demand for commodities.

Any large depreciation of China’s currency, the renminbi, could have a large impact on global trade and financial flows.