The title says it all. We are waiting patiently for more data, especially inflation data. Inflation has peaked, but its rate of decline has slowed, and where it settles is what matters most.

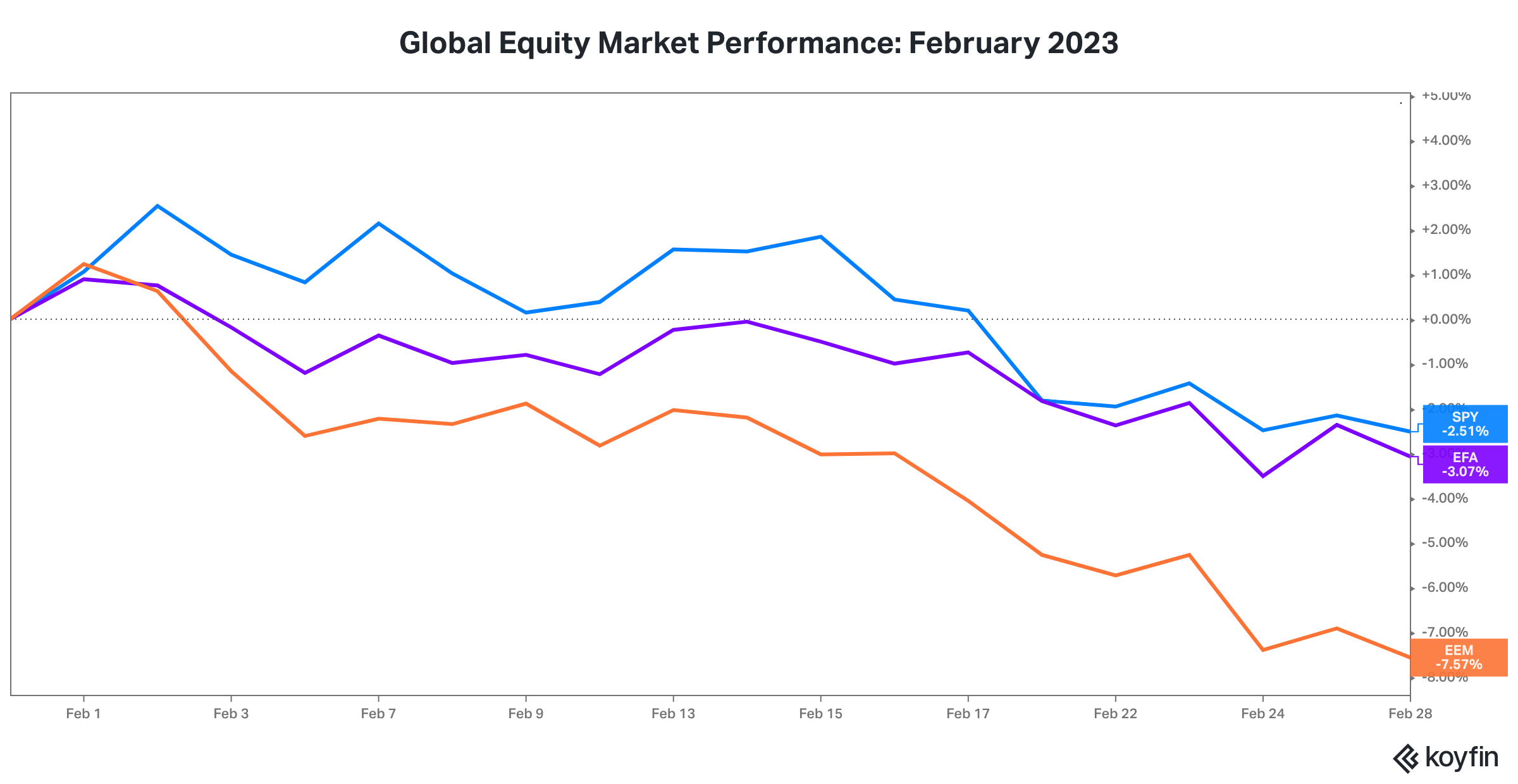

1. February was a weak though uneventful month for global equity markets.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in purple), and EEM (iShares MSCI Emerging Markets ETF in orange).

2. Corporate earnings season confirmed businesses are still dealing with cost pressures.

With 99% of S&P 500 companies having reported earnings, year over year revenue growth was solid 6.3%. However, earnings declined 4.6%. Profit margins declined in eight of the eleven sectors. The energy, industrials, and real estate sectors were the three exceptions.

3. The tightness in many segments of the labor market will continue to be a headwind for profit margins. Our bigger concern is the Federal Reserve’s reaction function if inflation remains sticky above a 4% level.

On March 1, Minneapolis Federal Reserve Bank President Neel Kashkari commented, "I think my colleagues agree with me that the risk of undertightening is greater than the risk of overtightening”.

If the Federal Reserve resumes more aggressive monetary tightening, the risk of a policy error will jump and a recession in the near term will be the likely economic outcome.