Capitalism, via competition, is inherently deflationary. Over the last two years, the creative destruction mechanism of capitalism has been overwhelmed by distortions from massive fiscal and monetary stimulus, global supply chain frictions, and years of underinvestment in crude oil and natural gas exploration and production. The end result has been high inflation globally. The good news is the inflation rate has likely peaked in the US. The bad news is Europe’s conflict with Russia and the U.S.’s conflict with China have created supply issues which cannot be overcome in the short term. As a result, inflation will remain elevated relative to the levels (~ 2-3%) to which we have become accustomed.

1. In July, U.S. inflation (as measured by CPI-U) fell to 8.5% from June’s 9.0% rate, which was the highest annual rate since the 1970s.

We anticipate inflation in the U.S. to moderate as the demand for goods continues to ease post pandemic. However, labor market challenges, structurally higher energy prices, and supply chain challenges emanating from China will put a floor on on the intermediate term range for inflation.

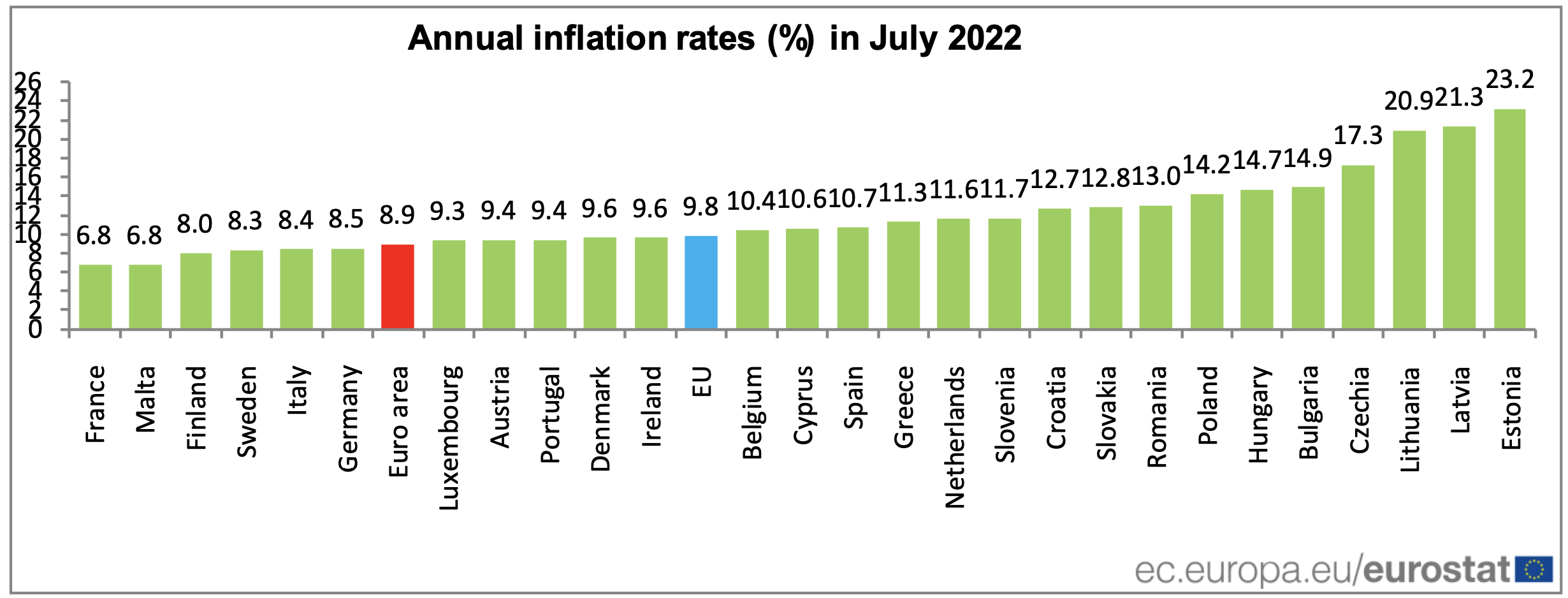

2. In Europe, inflation has not yet peaked. Consumer price inflation rose to an 8.9% rate in July from 8.6% in June. In Germany, Producer Price Inflation (PPI), a leading indicator for consumer price inflation, reached an astoundingly high 37.3% in July.

Europe’s inflation is driven by energy prices, as it is facing an acute shortage of natural gas because of its reliance on Russia for supplies. Russia’s invasion of Ukraine has reduced the production and export of many important commodities from both countries, the most notable being natural gas, which is important energy source for generating electricity. Recently, the stratospheric rise in natural gas prices in parts of Europe translated to over $1,000 per barrel on an oil equivalent basis.

Germany, the 4th largest manufacturer in the world after China, the U.S., and Japan, is facing an existential crisis, due to skyrocketing electricity prices, which has contributed to the 37.3% increase in costs, as measured by German PPI.

3. In August, equity markets and credit markets resumed worrying about the stickiness of inflation. Sticky inflation likely means continued aggressive Federal Reserve monetary tightening and more aggressive European Central Bank monetary tightening. More monetary tightening poses a risk to real economic activity (and corporate earnings) and to equity valuation multiples.

This chart shows the price performance of SPX (S&P 500 Index in blue), JNK (SPDR Bloomberg High Yield Bond ETF in orange)., EFA (iShares MSCI EAFE ETF in purple), and TLT (iShares 20+ Year Treasury Bond ETF in gray).

U.S. equities, as proxied by S&P 500 Index, declined 3.97% in August. Non-US developed market equities declined by over 6%, driven by European equity weakness. Credit spreads increased. Interest rates also rose across the yield curve.

Source: treasury.gov, Two Centuries Investments

4. China’s manufacturing sector has been facing the triple challenge of weakening demand, electricity shortages, and production disruptions from government lockdowns related to the COVID pandemic. The Chinese government seems complacent about the weakness, quite possibly because it is focused on both internal politics and frictions with the U.S. over Taiwan.

Source: National Bureau of Statistics of China. This chart shows the Purchasing Manager Index (PMI) of the manufacturing industry. The metric registered 49.4 percent in August, lower than the threshold for the normal level of activity,

China produces over a quarter over the world’s manufacturing output. Thus, it is the most important link in the global supply chain of goods. Taiwan is also the largest manufacturer of semi-conductors, which support our data driven economy and are increasingly integrated into equipment to provide digital capabilities. The integration of China’s low cost labor force and manufacturing capabilities into the global economy was a massive deflationary force over the last few decades. Any shift, whether higher labor costs, military conflict with Taiwan, or voluntary delinking from Western economies, will create global inflationary pressure.