The word guessing game Wordle has become all the rage on the internet. The financial markets are currently playing their own version of a guessing game. How high and how quickly will the Federal Reserve raise the federal funds rate? Was the equity market dip in January a harbinger of bad news or is it welcome development? How much of the rise in inflation is transitory? We address these pressing questions below.

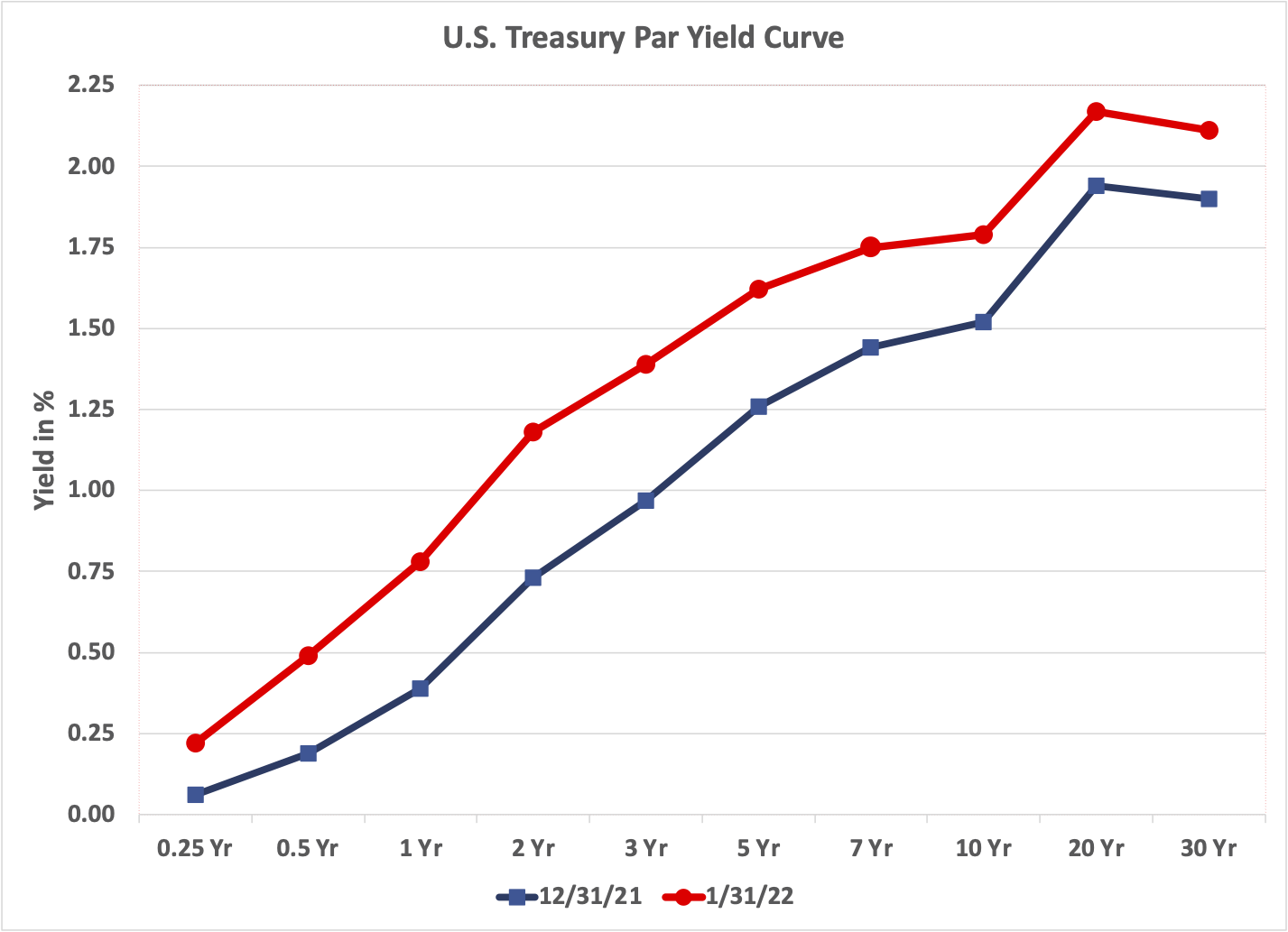

1. Interest rates spiked in January, driven by the inflation rate climbing to its highest level in four decades and the Fed confirming it will be raising the federal funds rate.

Source: treasury.gov

In January, interest rates spiked across the yield curve, even at the short end. In its January 26, 2022 press release, the Federal Open Market Committee (FOMC) stated “With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March.”

Inflation is forcing the Fed’s hand. Allowing high inflation to persist is akin to throwing sand in the gears of economic activity. In addition, persistently high inflation has the potential to erode the value of the US dollar. At a time of heightened geopolitical tensions, the US government will be averse to any erosion of the value of the US dollar versus the currencies of its adversaries.

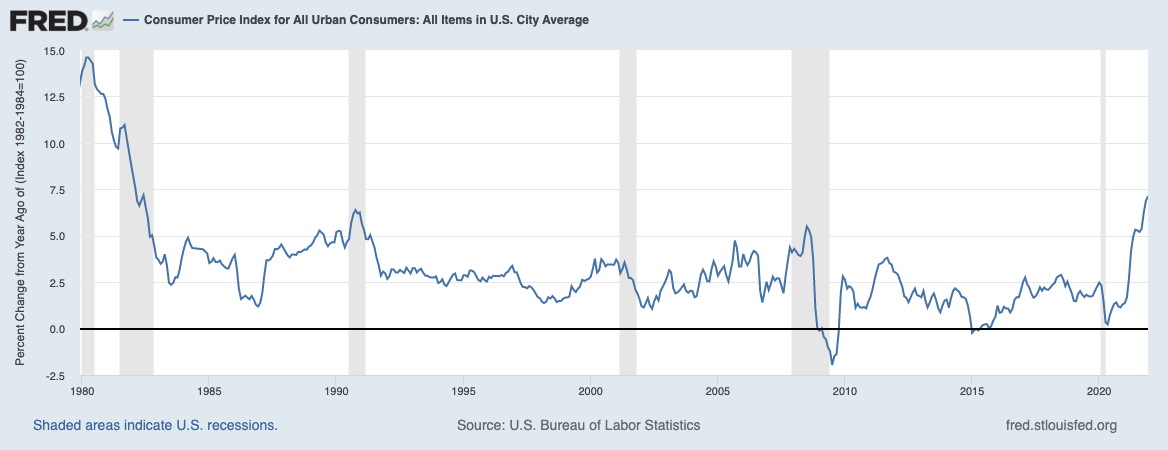

As measured by the Consumer Price Index for All Urban Consumers, prices increased 7.1% year over year in December 2021. The last time the US economy faced such price pressures was the late 70’s / early 80’s when I was a young teenager and gasoline had to be rationed.

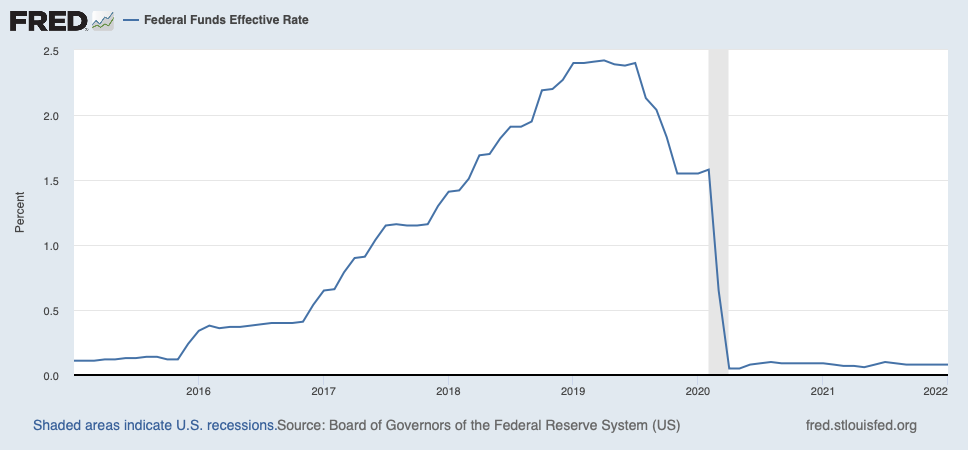

The last rate hiking cycle began in December 2015. Over the next three years, during a period where the inflation rate never exceed 2.75%, the FOMC gradually increased the target for the federal funds rate by 225 basis points. We anticipate a more aggressive rate hiking cycle since inflation is much higher today. Given the economy and financial markets are complex, adaptive, and reflexive systems, no one can accurately predict how the rate hiking cycle will play out. The only certainty is the rate hike uncertainty will increase market volatility.

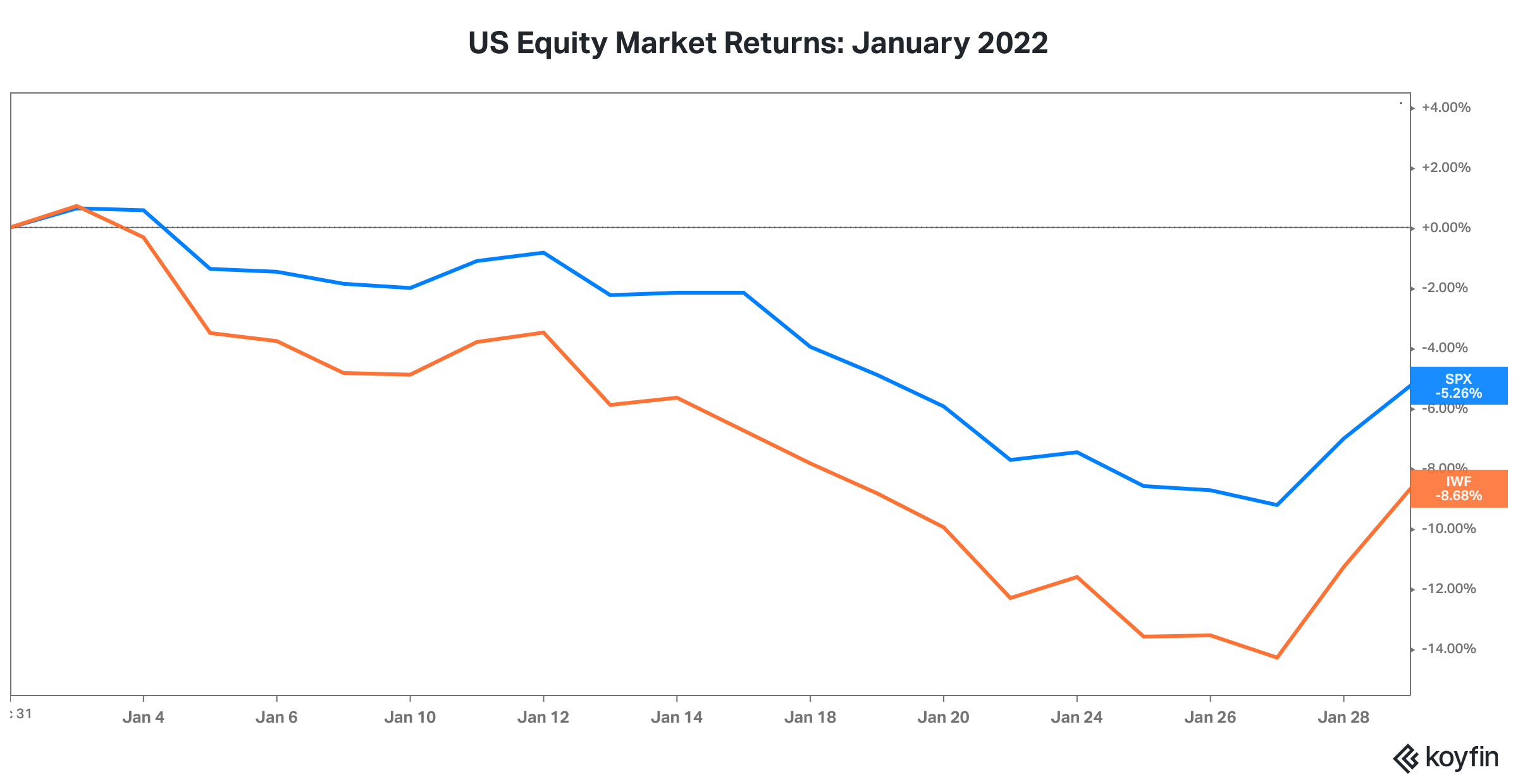

2. The US equity market swooned in January, an unusual occurrence in the first month of the year, as the prospect of interest rate increases spooked investors (or maybe forced a margin call on a few large levered investors).

This chart shows the January 2022 returns of the S&P 500 Index (ticker SPX, in blue) and the iShares Russell 1000 Growth ETF (ticker IWF, in orange).

The US equity market, as proxied by the S&P 500 Index, dropped by over 9% in January before rebounding to finish the month of January with a decline of only 5.3%. Large cap growth stocks were hit worse, dropping by over 14%, before rebounding to finish the month down 8.7%. The US equity market has been on a tear, both over the intermediate term (since the 2008 financial crisis low in March 2009) and more recently (since the March 2020 pandemic low). Growth stocks have also massively outperformed value stocks since 2009 and the more speculative ones traded at historically high valuations by late 2021. A hiccup is not surprisingly. Rising short term interest rates often force highly levered investors to de-risk. Rising long term interest rates are a negative for long duration assets, including stocks, but especially for speculative growth stocks with cash flow generation skewed towards the outlying years.

3. The good news is equity volatility did not surge in January.

Equity market volatility remains above the average level investors experienced post the 2008 Financial Crisis and pre the 2020 Pandemic. However, the current level, hovering in the mid to high 20 percent level is not signaling a near term contagion.

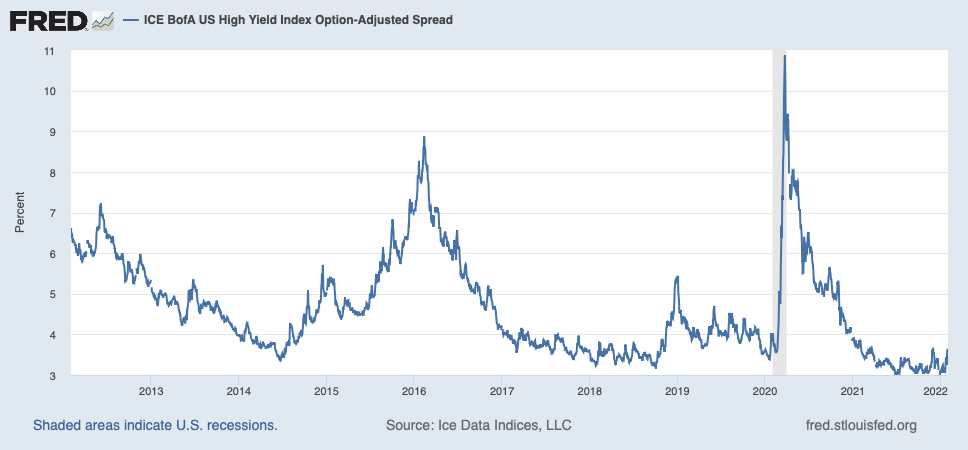

4. In addition, credit spreads remain low and only rose modestly in January.

Increasing credit spreads for non-investment grade debt is often an early sign of economic weakness. High yield spreads rose about half a percent in January, not unexpected given the Fed will be increasing rates. The modest rise is not signaling a contagion, but credit spreads bear close monitoring.

5. While the equity market, credit market, and real estate market remain relatively tranquil, the commodity markets are a different story. In particular, high prices for crude oil and natural gas are starting to weigh on economic activity. The combination of rising interest rates and high energy prices may prove to be too much for the financial markets and the economy to handle.

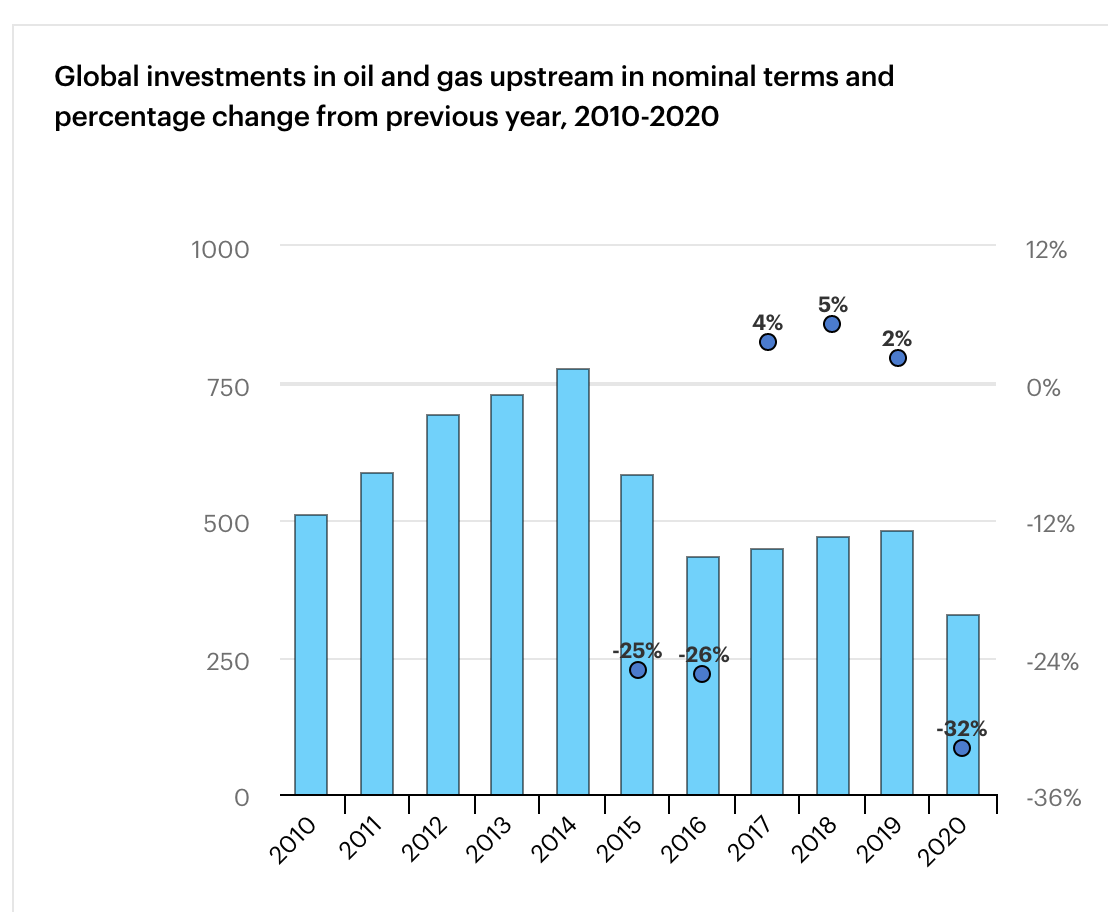

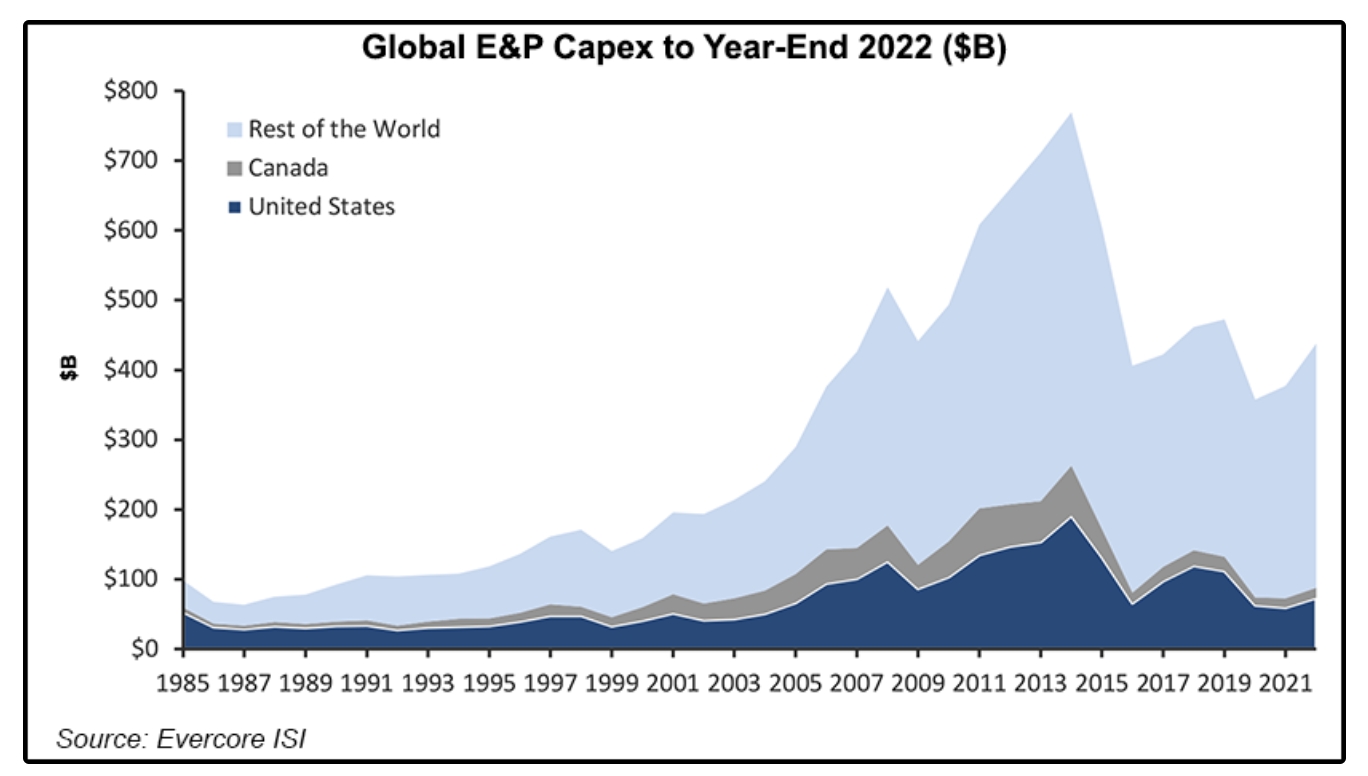

The cure for high commodity prices is high commodity prices. This statement reflects the reality that high commodity prices leads to demand destruction (bad for overall economic activity) and incentives supply growth (good for overall economic activity). Unfortunately, multiple years of underinvestment globally in crude oil exploration and production mean the supply response will be muted in the near term and intermediate term.

Source: IEA

The six years prior to 2021 saw three years of large declines and three years of low single digit growth in investment in oil exploration and production.

Exploration and production capital spending rose modestly in 2021 and is expected to rise again in 2022. It is too little too late. Higher energy prices are here to stay for the foreseeable future. As the global economy reopens post pandemic, there is a risk of another bounce higher in crude oil prices.

Over the last few decades, the global economic system has benefitted from many trends that have facilitated the efficient allocation of resources, including globalization, deregulation, technological advances, lower interest rates, and lower taxes. The contribution of low and relatively stable energy prices is often forgotten. Despite the adoption of renewable energy sources, the world economy remains highly dependent on crude oil. Higher crude oil prices, and thus higher energy prices, are going to bite into real economic activity until supply growth rebounds.

In summary, to subdue inflation, especially the energy price pressure, the Federal Reserve may be forced into a no win situation. Raise interest rates too slowly and inflation will become more entrenched, acting like sand in the gears that drive real economic growth. Raise interest rates quickly to suppress inflation and the economy and financial markets may not be able to digest the rate shock, leading to a crisis. Maybe the Fed can thread the needle, but there will be uncertainty along the way.

There will be more volatility ahead. Returns will likely be lower than investors have become accustomed to during the almost thirteen year bull market. Equity investors may even face another large drawdown. Now is the time to reassess your risk tolerance and ensure you have adopted an overall portfolio strategy that will help you stay invested no matter what happens in the future.