Here are top market developments we are monitoring.

1. The rebound of the U.S. stock market since mid-March has been impressive, but the recent parabolic upward movement of some U.S. large-cap stocks has been breathtaking.

In the five months ending August 31, AAPL stock rose 103.9% and the company’s market capitalization exceeded $2 trillion. Over the same period, TSLA stock rose 375.5% and the company’s market capitalization exceeded $450 billion.

We prefer to see equity markets slowly climb a “wall of worry” and not exhibit signs of euphoria and greed. Parabolic upward moves are often followed by sharp pullbacks, which if sustained, often instill a sense of fear in investors. Too often, investors gripped by greed and fear abandon their investment strategies and engage in value destroying trading activity.

We would not be surprised by an equity market sell-off, especially among the recent high fliers as their valuations are also extended. Many of these companies have strong underlying business models and associated intangible capital. However, a higher stock price translates to a higher bar (expectation) for future revenue and earnings growth rates. The bar has gotten awfully high.

2. Also breathtaking is the duration and magnitude of traditional value investing’s underperformance. The high valuation bar for growth stocks is a potential tailwind for value, but much of the recent underperformance is justified.

By one measure, as shown in the chart below, U.S. value stocks have underperformed U.S. growth stocks by almost 300% over the last eleven years.

This chart shows the relative total return performance of the iShares Russell 1000 Value ETF (IWD) relative to the iShares Russell 1000 Growth ETF (IWF) over the last eleven years ending August 31, 2020.

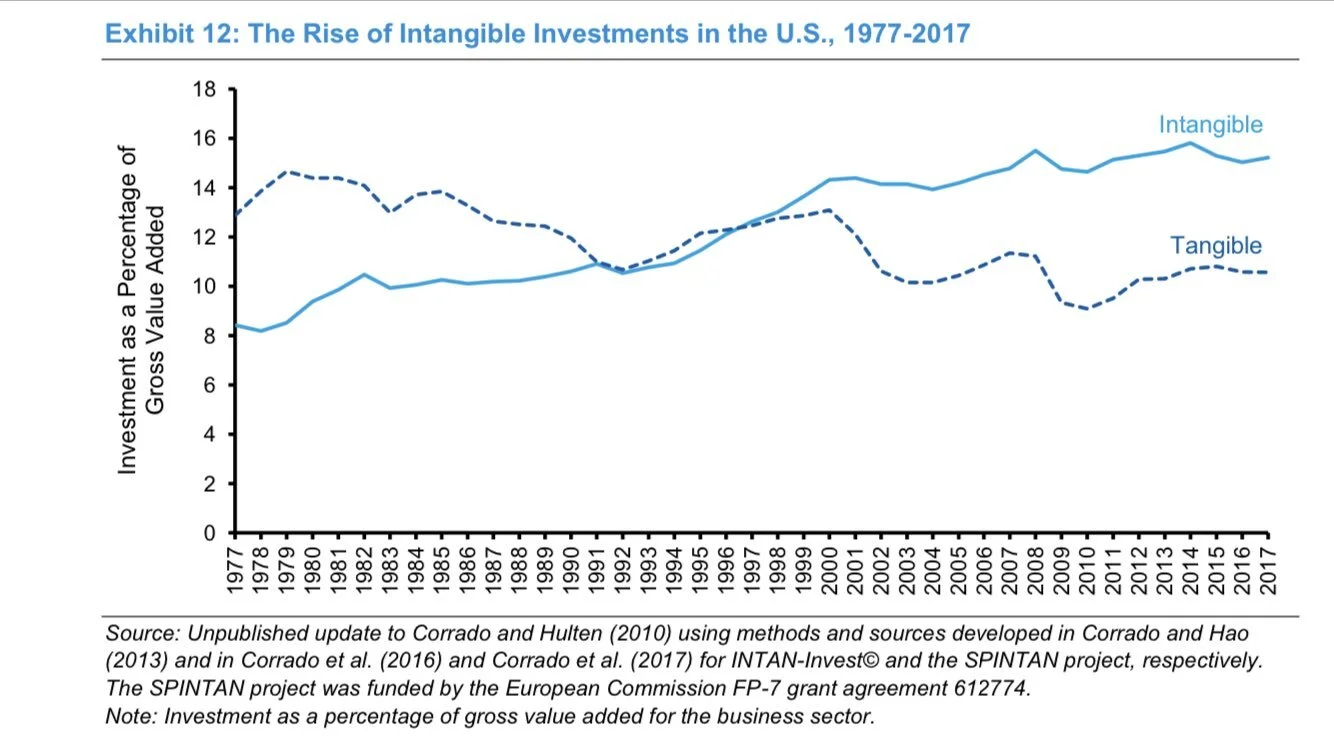

Many reasons have been postulated for value’s underperformance. We have sensed one big reason was the rise in importance of intangible capital (patents, network effects, human capital, etc.) vs. tangible capital (plant, property and equipment) in the U.S. economy. Two Centuries Investments flagship equity product is based on intangible capital.

Source: Morgan Stanley

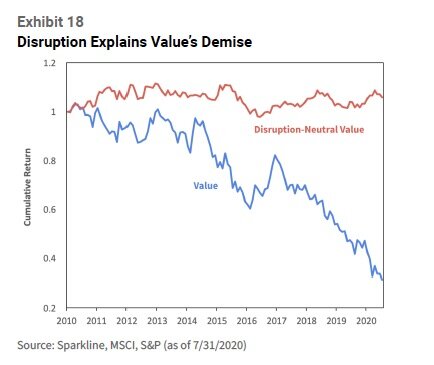

Thus, we were intrigued by a recent Sparkline Capital paper (here), which argued value investing’s underperformance can largely be explained by disruption caused by intangible capital, particularly business models and organizational designs based on technological innovation.

Source: Sparkline Capital. This chart illustrates traditional value investing underperformance disappears if its underweight (short) exposure to Sparkline’s proprietary “disruptive theme” is neutralized.

3. Credit risk continues to manifest itself. From our perspective, it represents more cause for concern than equity market euphoria.

As we discussed in July’s monthly update (here), credit creation is akin to the arteries in the body’s circulatory system. When the flow weakens too much, the economy will suffer. A primary goal of the massive U.S. monetary and fiscal stimulus is to arrest the rise in the corporate default rate so that it doesn’t reach the levels of previous crises. Defaults continue to rise. We remain attentive to developments in the credit markets.

The chart shows the historic trailing 12-month default rate for below investment grade issuers. The colored lines on the right axis indicate the possible default scenarios for the next 12-months as forecast by S&P Global Ratings Research.

4. Interest rates remain low, though longer maturity Treasury yields did bounce in August. The conclusion remains the same, namely it is difficult for businesses and individuals to generate interest income.

Source: Doubleline

5. We continue to monitor gold prices, which are signaling an erosion of confidence in the financial system.

Of interest, some large investors have recently taken an interest in gold.

Warren Buffett (via Berkshire Hathaway), a well known skeptic of unproductive assets like gold, purchased shares of gold mining company Barrick Gold (ticker: GOLD).

The $16 billion Ohio Police & Fire Pension Fund announced a 5% allocation to gold.

The Reserve Bank of India signaled a higher allocation to gold.