Adaptive Investing

for a Changing World

Insights

Blog

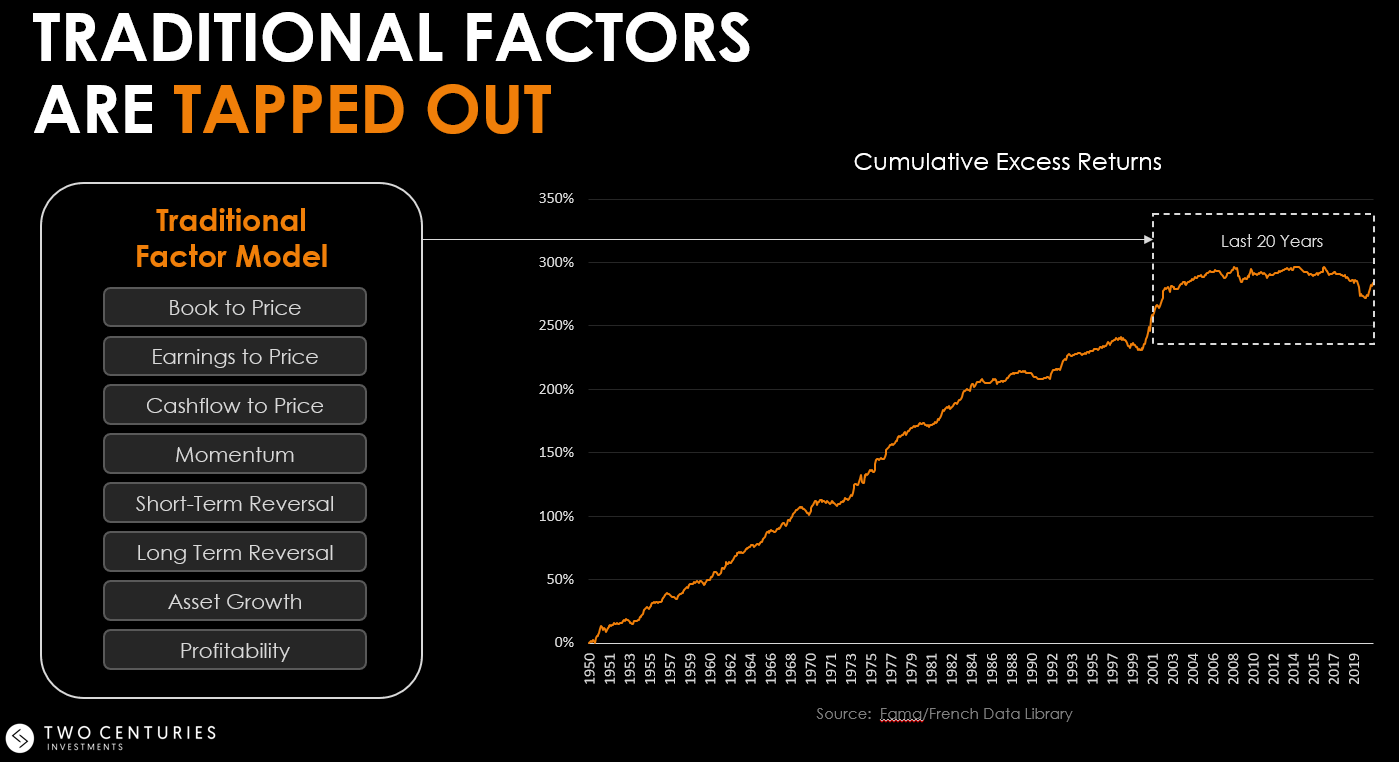

The power of Intangibles has been growing for the past three decades but 2020 marked the year that intangibles took center stage in the real economy.